Avoid The Pain Of Soaring Property Taxes With Our Guide: The 5 Best And Worst US Property Tax Cities

MyEListings' markets and economics editor and creates content about global macro events and their impact on US commercial real estate.

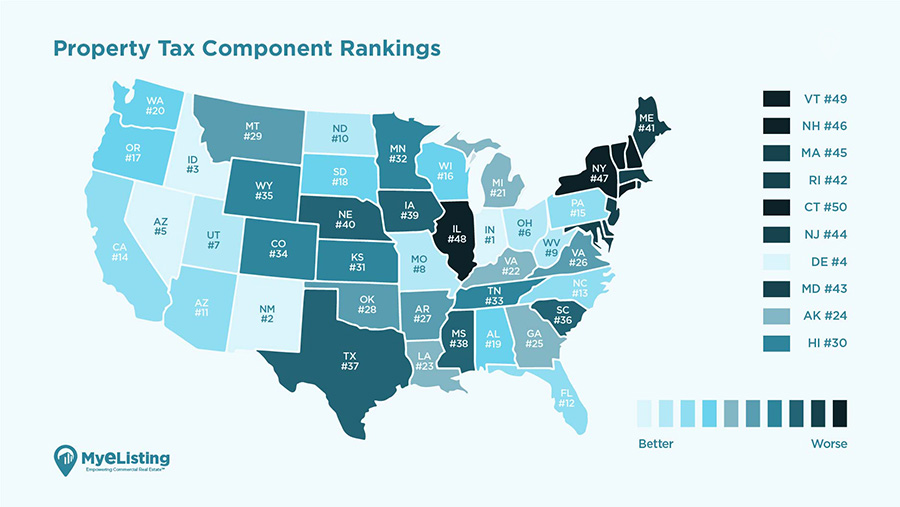

Property tax rates can significantly impact the cost of owning or investing in real estate. A favorable property tax environment can lead to increased property values, while high property taxes can deter potential buyers and reduce overall investment returns. In this article, we will explore the top five cities with the lowest property taxes, as well as the top five cities with the highest property taxes in the United States in 2023, according to The Tax Foundation. We will also provide unique commentary on each city to give readers a deeper understanding of the factors that influence their property tax rates and real estate markets. Property taxes are predicated upon state-levied rates. Cities and counties add their own assessments, compounding the amounts due.

5 Best Property Tax Cities:

City |

Effective Tax Rate |

Median Income |

Population Growth (2018-2021) |

Distance from National Median Income |

Areavibes.com Livability Score |

|---|---|---|---|---|---|

| Honolulu, HI | 0.27% | $80,513 | -1.05% | $9,729 | 82 |

| Montgomery, AL | 0.35% | $46,415 | 0.55% | -$24,369 | 65 |

| Birmingham, AL | 0.37% | $45,247 | -0.13% | -$25,537 | 65 |

| Cheyenne, WY | 0.54% | $65,484 | 0.15% | -$5,300 | 72 |

| Denver, CO | 0.55% | $73,223 | 0.70% | $2,439 | 64 |

1. Honolulu, Hawaii

With an average property tax rate of 0.27%, Honolulu offers the lowest property taxes in the nation. The city`s natural beauty, pleasant climate, and robust tourism industry make it a prime location for both residential and commercial real estate investment. Furthermore, Honolulu`s isolated location in the Pacific Ocean contributes to a limited supply of available land, resulting in a high demand for real estate and higher property values, even with low tax rates.2. Montgomery, Alabama

Montgomery has an average property tax rate of 0.42%, making it a very attractive option for investors. The city`s rich history, including its role as a pivotal location during the Civil Rights Movement, and growing economy provide opportunities for various types of real estate investment. Additionally, Montgomery`s low cost of living and business-friendly environment contribute to its appeal for investors and residents alike.3. Colorado Springs, Colorado

With a property tax rate of 0.49%, Colorado Springs offers a favorable environment for real estate investment. The city`s strong economy, driven by the defense and aerospace industries, provides a stable foundation for property value growth. Additionally, Colorado Springs` proximity to the stunning Rocky Mountains, outdoor recreational opportunities, and growing tech sector make it an increasingly popular destination for both residential and commercial investments.4. Boise, Idaho

Boise has an average property tax rate of 0.54%, making it an appealing choice for real estate investors. The city`s vibrant culture, including a lively arts scene and numerous outdoor activities, and growing tech industry contribute to its increasing property values. Furthermore, Boise`s low cost of living and reputation for safety and family-friendliness make it an attractive destination for both investors and residents.5. Charleston, South Carolina

With a property tax rate of 0.55%, Charleston offers a favorable tax environment for real estate investment. The city`s rich history, which dates back to the colonial era, thriving tourism industry, and booming economy make it an attractive option for investors. Charleston`s architectural charm and coastal location also contribute to its appeal, drawing visitors and new residents alike.Top 5 Cities with the Highest Property Tax Rates in 2022 |

|||||

|---|---|---|---|---|---|

City |

Effective Tax Rate |

Median Income |

Pop. Growth (2018-2021) |

Dist. from Nat. Median Income |

Areavibes Livability Score |

| Bridgeport, CT | 3.88% | $47,997 | -1.19% | -$22,787 | 57 |

| Detroit, MI | 3.77% | $35,683 | -1.51% | -$35,101 | 54 |

| Aurora, IL | 3.71% | $75,044 | 1.21% | $4,260 | 77 |

| Newark, NJ | 3.47% | $35,503 | -0.10% | -$35,281 | 52 |

| Milwaukee, WI | 3.32% | $45,089 | 0.05% | -$25,695 | 61 |

1. Bridgeport, Connecticut

With a property tax rate of 3.88%, Bridgeport has the highest property taxes in the United States. The city`s struggling economy and high cost of living make it a challenging environment for real estate investment. Additionally, Bridgeport`s reputation for crime and lack of significant job growth further dampen its appeal for investors and residents.2. Newark, New Jersey

Newark`s property tax rate of 3.05% makes it one of the least attractive cities for real estate investment. High taxes, coupled with the city`s ongoing economic challenges and high crime rates, contribute to reduced property values. However, Newark`s proximity to New York City and ongoing revitalization efforts offer some potential for future growth and investment.3. Detroit, Michigan

With a property tax rate of 2.99%, Detroit`s high taxes pose a challenge for real estate investors. Despite some revitalization efforts, such as the development of the downtown area and new sports arenas, the city`s ongoing economic struggles and high crime rates continue to impact property values negatively. However, Detroit`s rich automotive history and its efforts to diversify its economy by attracting tech and startup companies offer a glimmer of hope for future growth.4. Milwaukee, Wisconsin

Milwaukee`s property tax rate of 2.68% makes it one of the least favorable cities for real estate investment. The city`s manufacturing-centric economy and stagnant population growth contribute to sluggish property value appreciation. However, Milwaukee`s lakefront location, renowned breweries, and cultural attractions such as the Milwaukee Art Museum and the Harley-Davidson Museum provide unique appeal for both residents and tourists.5. Chicago, Illinois

With a property tax rate of 2.3%, Chicago ranks among the cities with the highest property taxes in the United States. High taxes, combined with the city`s fiscal challenges and increasing pension liabilities, make it a less attractive option for real estate investors. However, Chicago`s status as a global city, boasting world-class architecture, a thriving arts scene, and a diversified economy, may offset some of the challenges posed by its high property taxes for long-term investors.Takeaways:

Understanding property tax rates is essential for making informed decisions in real estate investment. Cities with low property taxes, such as Honolulu and Montgomery, offer attractive opportunities for investors, while high-tax cities like Bridgeport and Newark can pose challenges for both the investor and the local government. Before investing, it`s crucial to research the local tax environment and weigh the potential impact on property values and overall investment returns. Additionally, considering the unique characteristics of each city, such as its economic drivers, cultural attractions, and geographic features, can provide valuable insights into the potential for long-term growth and investment success.

Article Search

Share

All Article Categories