2023 US CRE Economic Outlook Contains Bright Spots

MyEListings' markets and economics editor and creates content about global macro events and their impact on US commercial real estate.

As we enter 2023, we see a world struggling with a top-heavy, globally-active economic system it has come to know and love seemingly threatening to seize, a land conflict in eastern Europe and a Chinese economy that has been alternately constricted and released for the past three years, creating ripples in the global economic fabric. All these factors weigh something in terms of their impact on US CRE markets, and in this outlook, we`ll examine some of the more poignant factors and their expected impacts in these regards.

The Big Pieces: Geopolitical and Demographic Concerns

Everything affects everything else. Everything weighs something. That`s the impetus for examining the global geopolitical backdrop as the base layer of analysis, because these represent the hard limits - the definitions, in other words - of the edges of what`s likely to come. In complex systems like global economies, the odd, seemingly small factor can mushroom out of nowhere into something entirely different.

Russia And The war in Ukraine

The United States has stumbled upon a new and better form of proxy warfare that enables it to leverage its advantages in high-tech weaponry by supplying them and their training to allied militaries. It is using this lever to effect in the Ukraine war. This conflict has always been Russia`s to lose, and lose they have, until this point. But if one looks more closely at Russian military history, one finds this type of setback in year one to be somewhat...normal. At such a point, Russia typically throws lots of bodies at the perceived problem, and about half the time it winds up working. We are at such a historic precipice.

There are other angles to the conflict, however. From the Russian point of view, this is an existential conflict. It has been invaded over the centuries by land so often it is defacto paranoid in its psychological makeup. This is really where many of the misunderstandings are rooted. Russia must expand its borders to feel secure. Its geopolitical imperative, from its own vantage point, is to expand its borders until it can anchor them against a hard geographic feature - a mountain range, a desert, an ocean - and then concentrate its forces on a handful of geographic access points enemies have historically used to access the Russian plain. There are nine of these access points, and Russia lost control of all but one of them when the Berlin Wall fell in 1989. It has since moved to shore up control over others through political machination. Ukraine did not play into this scheme, largely by US design. According to Russian geopolicial thought, the solution to their terminal insecurities is for them to possess veto power over the foreign policy of any nation that borders Russia - a population twice that of Russia, as a first step to total influence. This is a non-starter for the west, hence, the Ukraine conflict.

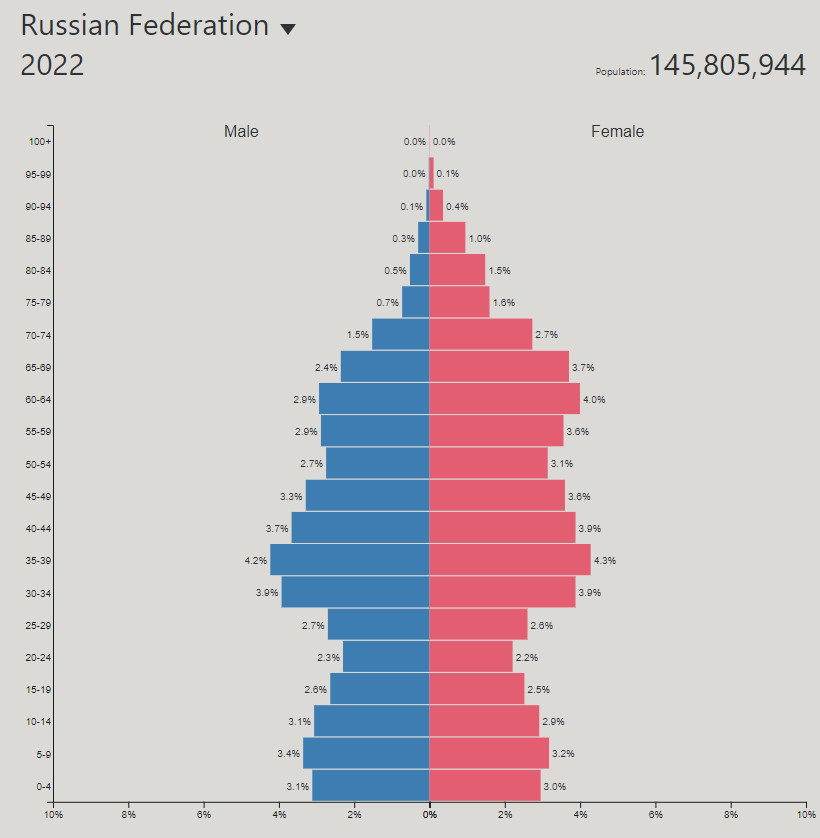

Russian Demography Is Terminal

The reason Russia believes it must do this now is that Russian demography is in terminal decline. This means they have more elderly than mature adults than young adults than teenagers, and all this implies. It means they must export because they cannot consume all they produce. It means they cannot support retirees in their retirement, because they do not have enough workers to tax to provide said support. And it means that young, vital, capable Russians have a very strong incentive to leave the country. But the biggest implication of this set of facts has been that 2022 was always the last year, mathematically speaking, Russia could field a force even remotely capable of re-securing these geographic access points to its heartland.

Russian Commodity Exports

Russia exports raw materials to the wider world, so anything that affects Russia affects global commodity markets. Oil, gas and fertilizer prices are all greatly affected by outcomes in the present conflict, and their knock-on effects impact every economy on the map. The combination of brutal sanctions, Russian inability to keep wells humming without western expertise and the Russian military strategy of throwing waves of meat at the problem will be the primary items to keep eyes on in terms of further effects. The elephant-in-the-room risk to the US in the conflict is ironically that Russia suffers a strategic defeat in short order and seeks to escalate. It is glaringly obvious to the west that any head-to-head conflict between the Russian military and NATO forces would be a 1000:1 slaughter at this point, and this highlights the risk of nuclear escalation, so a more drawn out strategy of bloodletting would seem to be the way forward. In no case will the US allow the Russian military to press westward and plug the Bessarabian or Polish gaps, and commodity prices are likely to continue their volatility, especially as the late spring approaches and troops can move again in-theater.

China

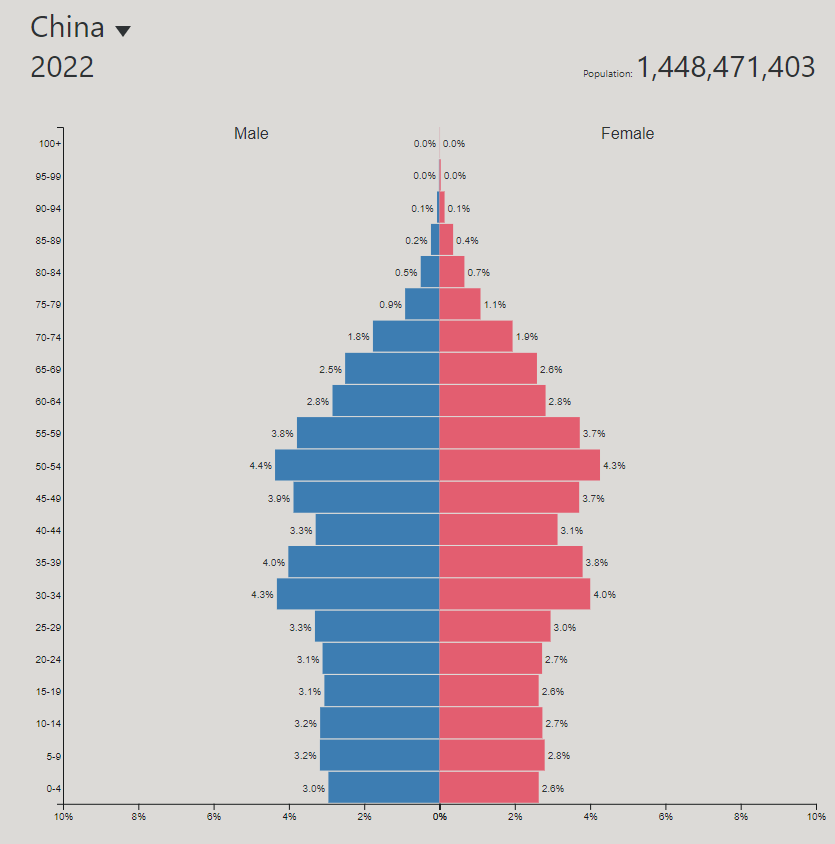

If you thought Russian demographics were messed up, you haven`t seen China`s. Not only is the same inverted pyramid in effect, where there are more 70 than 60 than 40 than 20-year-olds, but the Chinese have systematically overcounted their population, which renders every per-capita statistic they publish highly dubious. Moreover, President Xi has ensconced himself in a bubble of his own flunkies and yes-men, to the effect he doesn`t receive much, let alone accurate, information anymore. This is because he has purged the political apparatus of anyone who could possibly oppose him over the last few years and had himself named Communist Party Secretary for another, historically unprecedented term. The entire Politburo now consists of Xi allies, and no others exist. This renders the decision-making process quite subject to his whims, and since no one will bring him bad news for fear of being arrested (or worse) he gets bad-to-no actionable intelligence. One risk to this is the calculus of an event such as invading Taiwan, something that no one in his right mind could realistically consider using the Chinese military or logistical apparatus to achieve, doesn`t get done properly. An invasion of Taiwan would be almost literal suicide for China, as the sanctions the US has imposed on Russia would completely upend the Chinese economy in a fraction of the time, due to their scale, importance to the domestic economy and the ability of the US Navy to enforce them by remote control, through simple denial of access to allied shipping through Malacca, the Bosphorus, Suez, Gibraltar, etc.

Covid Lockdowns Ending

The Chinese economy has been under a rolling state of complete lockdown for the last 3 years, as they never developed an effective vaccine, therefore lockdowns were the only tool they knew to use for the purpose. But lockdowns are costly and ultimately untenable. The CCP finally acceded to very public demands to reopen the economy and halt lockdowns. This has resulted in a spike in sentiment as positive economic data printed everywhere, but these sentiments are likely to be disappointing, and short-lived. Chinese demographics are the reason. There have simply been too many mistakes made in public and economic policy for there to be a positive outcome; the one-child-policy, so-called `wolf warrior` diplomacy (head `wolf warrior` Zhao Lijian was just given a demotion that compares in scale to going from the C-suite to the janitorial closet), the atrocity that is the Chinese real estate market and COVID lockdowns would injure any economy. One with a pointedly at-risk demographic profile and a fertility rate and sex imbalance that are off the charts is nearly a slam dunk. China as we know it probably disintegrates this decade if history is a guide. This implies everything it would seem; capital flight, a dispersal of Chinese into pre-conceived diasporas around the world and dramatically falling output at home. This implies further dollar strength, as the rhetoric about China and Russia being able to integrate their economies and currency needs makes as much sense as pouring two bowls of rancid milk together to make them fresh again. Capital flight tends to find dollar-denominated assets, not assets denominated in a basket of desperate dictators` currencies.

The United States

This brings us to the US, where our analysis is mostly concerned. Here, we will primarily concern ourselves with the main CRE class designations, the macro environment and money markets.

Globalism is receding in the world for a host of reasons including a waning interest and ability in policing the world`s oceans on the part of the US. In addition to this, the moment in time we`ve experienced for the last 30 years, characterized by low interest rates, abundant capital, and the strongest demographic profile in the developed world, is over, structurally. Where Russian and Chinese demographic profiles resemble an inverted, top-heavy blob, the American profile looks more like a chimney - a much more solid structure. This will change in time, as the US fertility rate has fallen, but we will have the benefit of hindsight as other nations have struggled with their demographic crises, and will probably have an easier path to tread, therefore, with 30 years of experience watching others deal with it first.

Industrial Demand Is Organic

One implication of globalization`s fading with time will be the fact Americans will not tolerate a decline in their standard of living; however, to avoid such an outcome, we must approximately double the scale of our industrial plant in the next 4-5 years. All the long-distance inputs transported to Asia followed by more long-distance finished goods transport will begin to be cannibalized by regional trading blocs that more closely co-locate manufacturing with its consumption base - think Mexico and Canada, but also foreign brands that manage to cut advantageous trade deals to manufacture inside the US - these should continue to drive demand for industrial property, specifically manufacturing facilities. Certain types of properties may not fare as well as in years past, such as warehouse space, which likely needs to consolidate after the covid run.

US Economy Not Near Recession

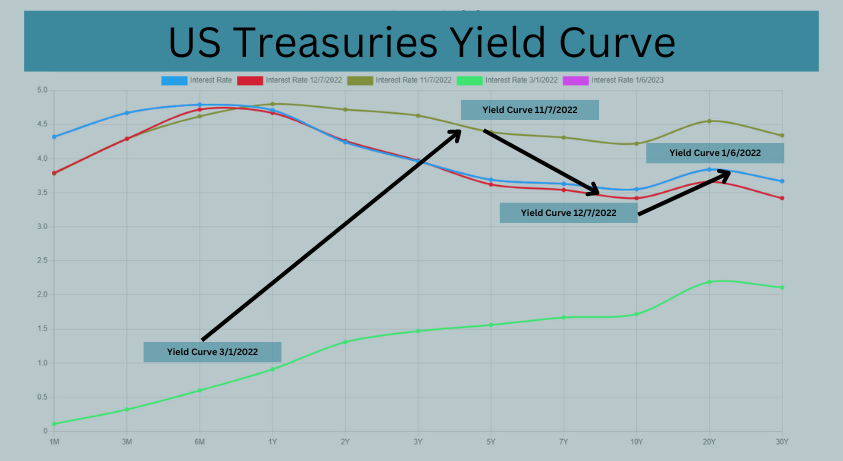

The US economy does not appear from current data to be anywhere near a recession, despite rhetoric to the contrary. In fact, it was technically in recession from Q1-Q2 2022 and nobody even felt it. The normal relative trickle of offshore capital into dollar assets has become more of a torrent, and threatens to become more of one. This has enabled interest rates to relax somewhat in the fall quarter, which has given some projects a new lease on life as the financial machinery has received some fresh oil after threatening to dry up. Loans that made no sense with the spike in 10 year rates suddenly made some again, and could complete. This is where we are at present, and the best tell in all of 2022 regarding fed policy was the fed itself. They nearly telegraphed every move and were quite communicative and less cryptic than usual. And their current stance suggests rates stay higher for longer, which is more the norm in the economy, the last 30 years notwithstanding.

Yield Curve Is Inverted But Should Improve

As the yield curve begins to normalize from its currently-inverted state, this implies a rise in the right tail of the curve more than it does an easing of short-term rates, although these will come with time (likely Q4 if not 2024). Another rise in rates implies financial conditions get difficult again and the bar for which deals can complete rises significantly. It also invites shadow lenders to the party, which tend to froth things up, as they don`t have the same set of calculations as more strongly-regulated lenders.

Office Properties

Other types of property classes will enter and/or continue the consolidation phases they entered last year. Lower-class office properties will need to be replaced or repurposed, and whether and to what extent and at what speed this can happen will vary by location and city planning department. Higher-class office properties will continue to attract remainers in the work-from-the-office camp, as lesser buildings in outlying areas line up for a rehash.

Retail

Retail properties are still very much in a consolidation phase, as the pandemic pointed up the advantages of online business over brick-and-mortar storefronts, but this is likely to see a reversal as rents recede, and cap rates correspondingly rise. The dichotomy between having a good be physically proximate and available with a short wait is a fluid one, and reactions happen after actions. The action, as it were, as been to bring up cap rates and down rents, and this is likely to continue in 2023, but slow down in preparation for a rebound as more businesses inhabit physical locations more advantageous to their consumer bases.

Multifamily Properties

Multifamily is likely the investment category with the most to lose, yet also the strongest underlying support in terms of demand. Cap rates, treasury rates, commodity prices and demographics all figure into the multifamily calculus, and with residential mortgage rates having spiked as they have by about 100% inside of a year while materials prices such as lumber have spiked and subsided again, these suggest the transition from renter to homeowner will be a slow one in such an environment, all else being equal. All else, however, is rarely equal, and if history has taught us anything, it is that a new law, a change to a regulation or even a new agency executive can make a big impact to consumer behavior. This could be a volatile sector, as the market seems to be lying in wait for a big REIT to puke its office or multifam portfolio. Churn, consolidation and repositioning are apt descriptors going forward.

Conclusions

Looking ahead, we note the following outlook considerations:

- Russia: demographically unfit, economically and militarily debilitated, but throwing bodies at the problem. Unlikely to work, but history says 50/50, so eyes on. Personally doubt they can muster the strength to push through, but from the US point of view, the conflict must drag on and eventually die in Ukraine, because actual conflict between NATO and Russian forces could result in faster escalation as Russian strategic retreat and collapse would likely ensue.

- China: putting lipstick on the pig just isn`t a good look. Chairman Xi has insulated himself in a sphere of biased intelligence, and thus runs a risk of making a poor decision at scale, such as attempting an invasion of Taiwan. Any such event would likely end the Chinese economy inside a year, as the repercussive sanctions would be an order of magnitude more effective than Russian sanctions are against Russia. The US, Japan and their allies in the region would not tolerate any such act militarily either. The logistics of any Taiwan invasion would scare off the most seasoned military planner - China lacks both the hardware and the experience to pull off a fraction of what`s required, so I`d put the odds of this at a low figure, but not zero - because Xi could be allowed to make such a poor decision by his surrounding yes men.

- The US is regionalizing much of its trade into the western hemisphere, and struggling to contain inflation at global scale since most of the world uses dollars in trade. This means rates are likely to remain higher for longer, even as it becomes apparent the rate hikes are having an impact domestically.

- With globalization ebbing from the world stage, the impact of superfluous costs in the system should begin to be eliminated. Environmental, Social & Governance (ESG) investment mandates will likely begin to be ignored, as their benefit-to-cost ratio is only acceptable in a low-rate environment, which is gone.

- Americans will not tolerate a lowering of their living standards or access to luxury goods or services. This, however, requires a rough doubling of our industrial plant in the next 4-5 years under current conditions. This `shadow demand` is likely to keep a bid under certain types of industrial property, especially new-tech manufacturing properties.

- Multifamily feels like it`s waiting for some big investor to puke its portfolio, and this is because this would be an opportune time for a newly-disinterested investor to jettison a block of properties, with rates having cooled from their peak, but likely to at least test it again. Most room to fall in this category.

- No recession in 1H 2023 - the prereqs just aren`t in place, despite the narrative to the contrary. Will update as we progress.

Here`s to a very happy, healthy and prosperous 2023. Happy New Year, everyone.

Article Search

Share

All Article Categories