Is Multifamily Finally Starting To Crack?

MyEListings' markets and economics editor and creates content about global macro events and their impact on US commercial real estate.

Multifamily properties have been star performers of not just the pandemic period, but the years that led up to it as well. But cracks are beginning to appear in the gleaming multifam facade. Here, we explore the big-picture drivers of the multifamily property boom, and whether they can be sustained as seismic shifts occur in the global economy.

Why Are There So Many New Apartment Buildings?

Apartments, the category into which most multifamily properties fall, serve a general purpose in the US economy: they provide shorter-term, time-bounded housing units for members of the population who do not wish, or do not qualify to own a home.

Financially, lending standards have not resumed their lack of presence last seen in 2008, and at least partly as a result of this, the average age at which people buy their first home has grown from 29 in 1986 to 33 today. Generation Z, the US’ youngest available cohort, ranges from age 10 to age 25, as of this year, suggesting this group won’t hit its prime home-buying years until 2030. They are forming households at a faster rate than house inventory is growing. In the meantime, boomers are living longer, and are not especially in the mood to sell the homes they have paid off or have a lot of equity and a very low mortgage rate. Millennials, the next oldest cohort to Gen Z, and a larger generation than the boomers have begun buying, but later than their predecessors, creating a kind of gap in the market.

New apartment construction has been increasing in an attempt to offer new market entrants with higher incomes than ever an alternative to leasing an older, less desirable living space or having to scrimp, save and jump through all the hoops home lenders put in place for them. New units are often built to include gymnasiums, private office spaces, and other amenities that make apartment living more tolerable and even desirable for some, in the meantime. And lenders have been there with capital to make these projects happen. This could be shifting.

Cracks Appear As Rates Rise

The Federal Reserve has increased short-term interest rates, via its Fed Funds Rate target by the greatest percentage since its inception in 1913 in just the last 7 months. This creates a lot of noise and froth in the markets as other instruments from short-term treasuries to longer-term treasuries to corporates to money market instruments must shift to reflect this reality. Cap rates are a function of these underlying rates, and must respond when they shift, hence their recent surge.

As cap rates have risen, property values have necessarily declined, because the cap rate is defined as the net operating income of a property over its purchase price. If you own a property at a 2.5 cap, meaning a $10 million property spins off $250k in annual income, and the 10 year treasury rises to 4%, you’d rather own the treasury, all else equal, because it’s considered risk-free, whereas you’re earning less despite taking a risk in the property. Cap rates must adjust to keep up with fed machinations, therefore.

Demographically-Driven Processes Move Slowly

Watching demographic processes make an impact is arguably more boring than watching paint dry. We’ve known baby boomers would hit mass retirement this year for decades. We’ve known China and Russia would hit demographic cliffs right now for years. These processes, because of their real-world scale, can sneak up on news cycles quite insidiously. And these processes underpin much of what we are seeing in the United States, and more aptly the world at present. However, they’ve taken many years to compound to their current state of potential criticality.

As market forces struggle to respond to interest rate machinations at the front end of the yield curve being served up by edict, uncertainty necessarily expands in the system. After all, market forces are organic. Federal Reserve policies are the product of a committee that thinks it can override and supplant market forces. And that’s not a bad thing, as long as they manage to get it right. But they don’t always get it right. Forcing the economy into a state that’s inhospitable for businesses or employment to achieve a pre-ordained policy target is a lot like trying to create economic value through mass layoffs. Sure, the ‘economic value’ column increased, but at a lot of families’ expense, leaving one to wonder if this is really what we’re after in pursuing such a policy.

The Same Market Forces VS Edict Responses Occurring In Multifam

As marginal renters (read: the next people to need to rent a housing unit) shift their behavior, it changes the market, because market expectations are that they will consume a certain number of units, given a set of assumptions. As marginal investors (those next to develop a multifam project) change their behavior, it changes the structure of capital markets. Investors are largely responding to what the fed has decreed, however presciently, whereas renters are responding to inputs that are more ‘real’ in a sense. And that’s where this dichotomy can start to fray.

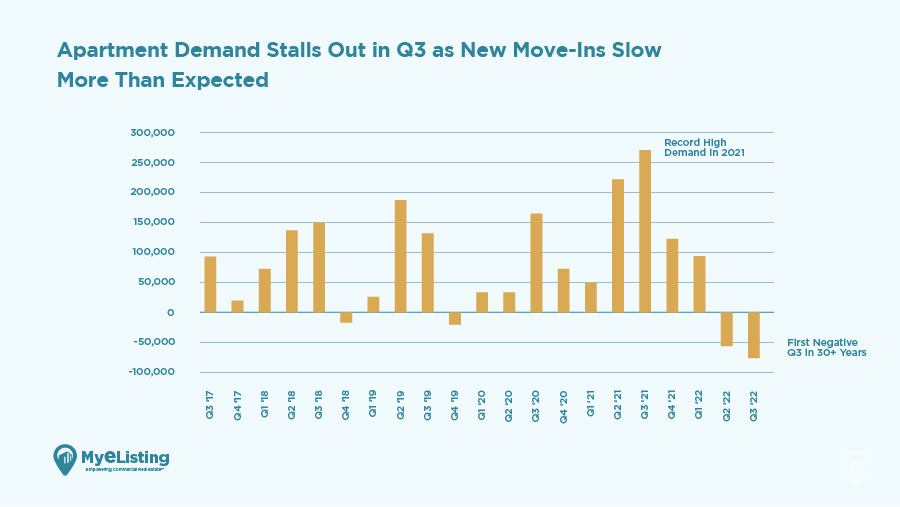

New Move-Ins Nationwide Have Begun To Ebb

>

>

While the slow-motion demographic process investors have based their projections around proceed in a plodding fashion, and cap rates rise to reflect fed policy directives, it might occur to some that these forces could part ways at some point. Could that be what we are beginning to see in the data? Time will tell, but the bet that says the fed will be correct in its machinations and definitely not make a policy error has been a very inconsistent one.

Conclusion

Multifamily has been the star asset class in CRE for some time and has attracted the usual spate of syndicators looking to fund deals with unsophisticated investors’ capital. While the fundamental assumptions underpinning the investment story in multifam appear sound, they are not set in stone, and they appear to be shifting. At the same time, cap rates are forced to rise to reflect changing Fed policy. These forces oppose each other, with rising cap rates lowering property values and greater numbers of renters increasing them. If these forces were to somehow line up on the same side of the fence, we could see things get messy in multifam.

Article Search

Share

All Article Categories