What Is Inflation? How Does It Affect Your Investments?

MyEListings' markets and economics editor and creates content about global macro events and their impact on US commercial real estate.

At a 40-year high of 9.1% in the US as of July 2022, inflation is the talk of not just the town but every county, borough, and village around it.

But “inflation” means more than just a climbing Consumer Price Index and astronomically expensive gas. In order to properly grasp its ramifications in the most effective, actionable way, a more modern understanding of the idea is required.

Let’s take a step back from the headlines and into the headwinds.

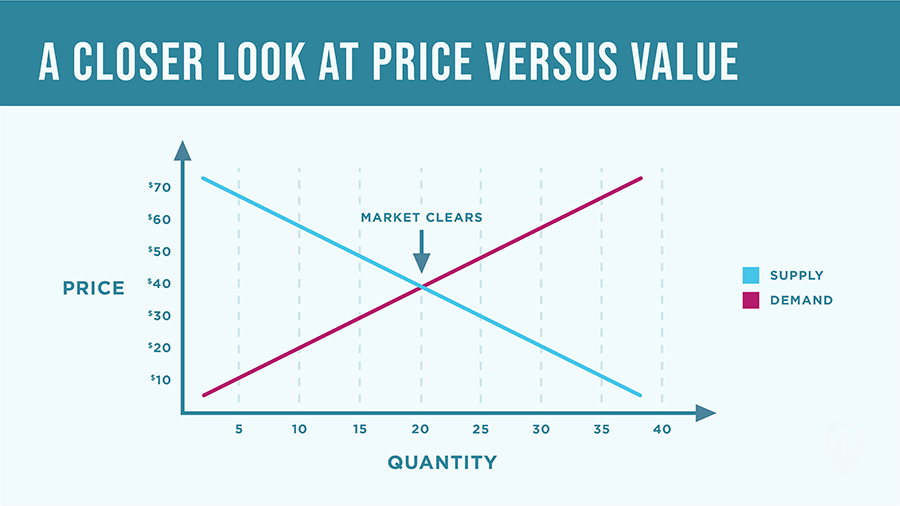

A Closer Look at Price Versus Value

Prices, in a well-functioning market, convey information to individual market participants about the aggregated buyers (demand) and sellers (supply).

Specifically, the price at which a market "clears" is said to be where supply and demand meet, and it is a fluid dynamic: Prices move around with changes in supply and demand.

Should supply constrict and demand remain constant, prices will rise, while lower demand with supply held constant will yield lower prices.

Not All Price Increases Are Inflationary

These changes in price in response to shifts in supply or demand are not inflationary per se but are in fact the normal functioning of a market. Prices go up and prices go down as inputs shift.

But then there’s a slightly more individuated concept that we compare to price at the individual level: value.

And value, unlike price, varies from personal preference to personal preference. The difference between price and aggregated value is a more accurate depiction of what economists mean by "inflation" than simple price increases. If an economy "prints" 20% new currency, but invests it in technology that increases output, this can work, theoretically.

Rising prices, then, can be a symptom of inflation, but are not necessarily the thing itself.

Likewise, not all declining prices are rightly called deflationary: Technology, for example, tends to create orders of magnitude more in value while falling over time in price, but labeling this deflation, the same term describing monetary conditions during the great depression, completely misses the mark.

How We Report “Inflation” Is Flawed

The way we measure and report inflation, however, is only about price increases. There’s no value aggregation component against which we can compare the price increases.

This can be problematic because what we are reporting are net price changes, which can occur for various reasons that are not "inflation" per se.

Prices Change at Different Rates for Different Goods

A rising Consumer Price Index (CPI) simply tells us by what amount prices rose throughout the reported period of time.

What it does not communicate, however, are any changes in how the public interprets the value found in those items.

In other words, the price of a hamburger may have risen by a dollar, but it remains unknown, according to the CPI, whether that price increase is due to a declining public appetite for hamburgers or increasing production costs.

This element must be teased from the data through other methods.

For example, we can surmise that, if prices rise 10% in response to a given increase in demand for one commodity where they rise 15% for another in response to a similar increase, the latter is deemed more valuable in the aggregate.

Goods like food, water, and fuel typically respond this way and are called inelastic for this reason: Prices don’t stretch to accommodate demand or supply shifts but are tightly geared to their perturbations, unlike more elastic goods such as furniture, jewelry, or electric fans.

Understanding what inflation is and isn’t is crucial for any investment portfolio: It erodes the purchasing power of currency which, in turn, implies that holding cash is detrimental.

However, it also signals that holding risk assets is advantageous because the prices of those assets are rising in an inflationary scenario.

But this is overly simplistic: Those assets are earning income which is currency and therefore inflating, creating more of a complex scenario.

Introducing the Carry Trade

One way around this complex scenario is to earn income in a currency that is inflating relatively less while borrowing to purchase assets in a currency that is inflating more, allowing the investor to repay the borrowed funds in cheaper units.

Weak currency means purchasing power is eroding and, therefore, the borrower is repaying with currency units worth less than when borrowed.

In times of global uncertainty, investors tend to buy dollar-denominated assets using Yen, Turkish Lira, or even Euros, as those currencies are issued by regions with a need to export goods that their aging or otherwise-unable consumer bases don’t consume.

When countries export, they need to maintain cheap currencies relative to others. We can see this playing out now in currency fluctuations: the Bank of Japan has not raised rates even as the US and others have.

This is because they can’t, not because they don’t want to.

A Quick Primer on Sovereign Debt and Money Markets

Developed countries tend to set short-term interest rates, the rates at which central banks lend to members and members lend overnight to each other by edict. The Federal Funds Rate in the United States is an example of this.

Then the other rates, one to three-month treasury securities; two, five, ten, and 30-year bonds specifically, adjust in response to the short term rates.

Longer-term rates, then, are more a product of market forces. The relationship of these rates to each other are plotted along a line called a yield curve.

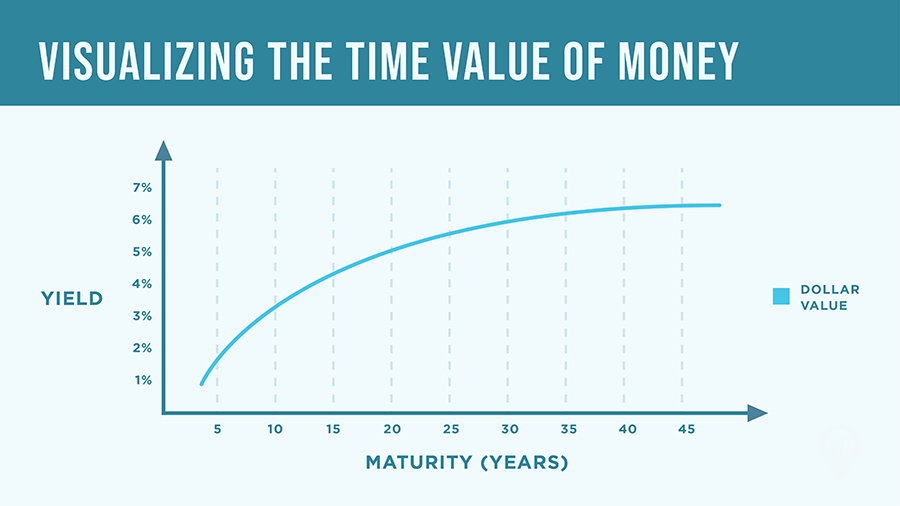

Visualizing the Time Value of Money

The yield curve illustrates a fundamental truth in economics: the time value of money. A dollar today is worth more than a dollar tomorrow, all else being equal.

This implies that the rental rate for money, the interest rate, is naturally higher for longer-term instruments than for shorter term ones.

The 30-year treasury, in a normal market, will carry an interest rate that is higher than the 10-year, which is higher than the five, the two, the threemonth, etc. This creates the up-and-to-the-right slope of a healthy yield curve.

But yield curves don’t always slope up and right. Occasionally, they can become inverted, or develop kinks, especially at points in the middle of the curve.

When this occurs, it tends to be temporary because it represents a bastardization of market forces: It shouldn’t get an investor a better rate to borrow for ten years as opposed to five, which implies a dollar tomorrow is worth more than a dollar today.

Many investors interpret such occurrences as harbingers of imminent recession, and for good reason: Yield curve inversions do correlate very closely with the onset of recession, defined as back-to-back quarters of negative GDP growth.

The Business Cycle, Macro Demographics, and How to Use Them

By the time a country is officially in recession, its GDP has been negative for half a year already. People start acting like they’re in a recession, spending more conservatively, shifting spending patterns, being afraid to invest, etc., when precisely the opposite is called for.

This brings us to the first point on how to use inflation to your advantage.

Understand that economic pronouncements are about the past, not necessarily the present, and inverted yield curves are important historical signposts.

Right at this moment, in early July 2022, the United States Treasury yield curve is flat from the ten-year bond to the two-year note, meaning little to no difference exists between the yields of these differently-dated instruments, which signals uncertainty and probable recession.

Fear, Greed, & Optimizing Around Time and Liquidity Constraints

Markets run on fear and greed, and generally speaking, good investors tend to be greedy when others are fearful and fearful when others are greedy.

But there’s also the factor of timeframe; some investments require a longer time horizon than others due to their illiquidity, among other factors, and much of real estate fits this description.

Simply put, real estate investors must generally invest with a longer time horizon than, say, stock or macro investors.

How does inflation affect your investment portfolio?

The bottom line is that inflation tends to express itself as higher prices not just for consumer items but for risk assets as well.

This means that holding assets should allow an investor to participate in the inflation and that holding cash should carry with it a liquidity penalty, since liquidity is at a premium in a rising rate environment.

This premium gets expressed as higher interest rates over time: As they rise, the premium accorded to liquidity (holding cash) rises and attracts more capital to the cash category, which ultimately acts as a brake on rising rates, and the cycle can repeat.

Making Smart Investments in Inflationary Environments

How can we invest more astutely in an inflationary environment? Understanding that there is a penalty associated with holding liquidity is an important insight.

Understanding further that this penalty can be at least temporarily offset by borrowing in weaker currencies is advantageous, and understanding the mechanics of how to do this can be quite so.

Understanding what’s driving the slippage between price and value, however, can allow an investor to better navigate the complex landscape.

Understanding further that the financial end of the transaction,where funding comes from and how it gets repaid can be optimized while holding longer-time-horizon assets, can be a substantial lever in dialing in an investor’s risk profile.

Why Technology Matters in Estimating Inflation

So what’s driving this inefficiency? Slippage between price and value typically arises from shifts in the underlying inputs, either supply or demand or from changes to the monetary system itself.

Consider the case of the Qin Dynasty in China, where paper money first appeared. The emperor forced citizens to pay for all personal debts and transactions using this new, government-issued paper money, and then began printing more of it to pay the empire’s debts as well.

If price is calculated in currency-unitsper-goods units (dollars per unit, e.g.), and the number of currency units increases while goods remain constant, simple arithmetic shows prices must rise.

However, other factors must be considered, such as the aggregated effect of technology.

Technology allows greater output per unit of input, the inverse of inflation. As it accelerates, it enables a certain amount of inflation to exist that could otherwise be devastating.

If graphics cards, CPUs, and data storage weren’t cheaper year over year, fewer dollars could be issued/printed than otherwise without being overly inflationary.

The specific drivers contributing to perceived inflation matter as well. The need for large-scale economic shifts, such as the need to re-shore US manufacturing capacity in the current environment where global supply chains are deteriorating, tend to color the character of the inefficiency as well.

In the US, for example, the baby boom generation is now in full-scale mass retirement, creating a structural deficit of very high-value jobs. These get filled by the next rung down, etc., until the bottom of the ladder, temporary and entry level work, are where they accrue.

These are manifested in higher wages across the labor market. These conditions are baked into the market at this point: higher structural wages, employment rates, and demand for industrial property.

The inefficiency increases as a function of the number of square pegs in round holes that must be relocated.

More Options Doesn’t Mean Fewer Risks, but Different Ones

The same advantage that accrues to the borrower of a weak currency works against the borrower of a strong currency: They pay the loan back in more expensive dollars.

Risks abound, even with or perhaps especially with, increased options for trimming out a portfolio. The idea is to maintain investment in risk assets to the extent possible, thus avoiding the deterioration of holding cash in an inflating environment, while also maintaining "dry powder," or the ability to take advantage of opportunities that arise in the form of foreign currency credit.

With the seismic shifts in progress in US commercial real estate at present, the rising rate environment and the inability of certain countries to raise rates themselves in response, an opportunity exists for sophisticated investors to offset certain risks of inflation. It should be studied and executed upon.

Article Search

Share

All Article Categories