2022 Multifamily Market Report: Miami

Specializes in providing actionable insights into the commercial real estate space for investors, brokers, lessors, and lessees. He covers quarterly market data reports, investment strategies, how-to guides, and top-down perspectives on market movements.

Miami maintains one of the strongest multifamily markets in the United States. Investors traded more than $7 billion in multifamily assets in 2021. This was a regional record at the time.

2022 continues to be a very strong year for the multifamily market in Miami. 2021 was among its best years in several decades.

New technology and financial services companies are entering the market, bringing high-wage earners into South Florida.

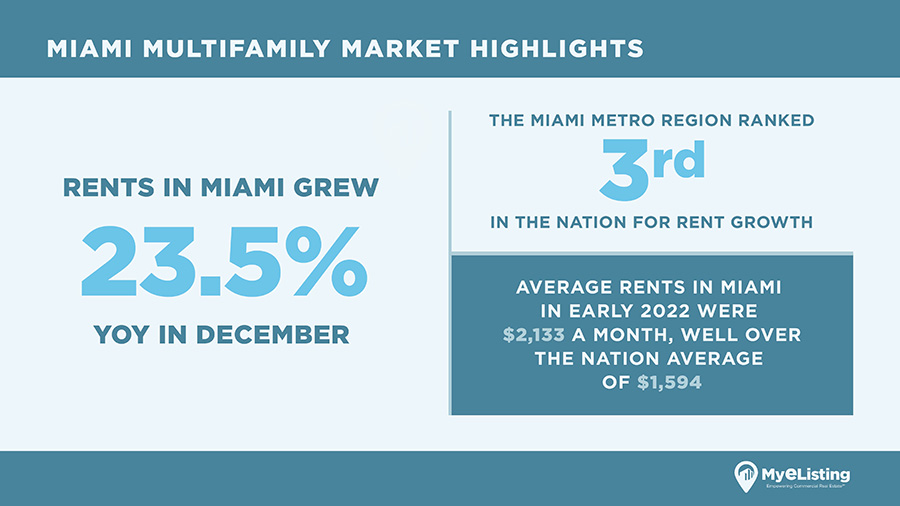

Miami Multifamily Market Highlights

The Miami multifamily market report demonstrates how the past few years have been favorable in this market. Some highlights include:

- Rents in Miami grew 23.5% YOY in December;

- The Miami metro region ranked 3rd in the nation for rent growth;

- Average rents in Miami in early 2022 were $2,133 a month, well over the national average of $1,594.

Miami is one of the hottest multifamily markets in the nation. Generally, people want to live where it’s warm and more affordable.

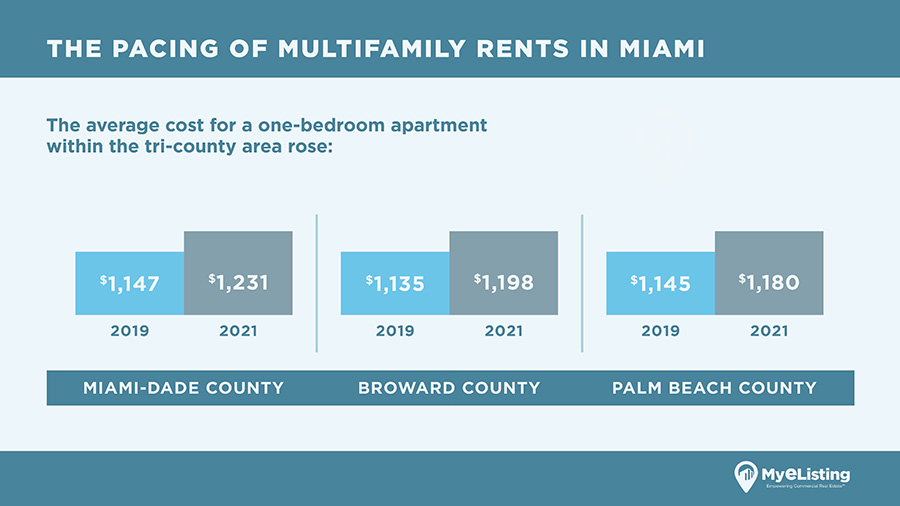

The Pacing of Multifamily Rents in Miami

In the United States, the average rent in 2021 rose by 11.3%. Rents in Miami rose somewhat from pre-pandemic averages to 2021.

The average cost for a one-bedroom apartment within the tri-county area rose:

- Miami-Dade County from $1,147 in 2019 to $1,231 in 2021;

- Broward County from $1,135 in 2019 to $1,198 in 2021;

- Palm Beach County from $1,145 in 2019 to $1,180 in 2021.

Miami rents should continue to rise over the foreseeable future in all three counties, as more people opt to move to South Florida.

Long-Term Changes in Rent

Rents should continue to rise over the long-term.

As more companies and residents flood the city, the demand for luxury apartments and Class A office spaces in the region.

Short-Term Changes in Rent

Rents in Miami are growing rapidly in 2022.

While the data is not yet out on average rent prices this year, it is expected to continue growing at a rate higher than many other cities in the United States.

Multifamily Sales in Miami

There have been many notable multifamily sales and acquisitions that took place in the Miami market over the last year, including the following.

Notable Acquisitions So Far

Multiple developers have plans for Edgewater and the surrounding neighborhoods in Miami.

Reports show that more than $500 million was spent by multiple developer groups to acquire property in Edgewater, alongside several roads that are planned to begin construction.

All of the properties are zoned for multi-hundred multifamily units.

In late 2021, Cardone Capital completed the purchase of a four property portfolio in Florida worth $740 million.

It includes nearly 1,700 units in and around Fort Lauderdale. Cardone Capital purchased more than $1.2 billion in real estate nationwide and currently holds more than 11,000 units.

March 2022 saw the acquisition of ParkLine Miami by Harbor Group International for an undisclosed amount.

ParkLine Miami has 816 luxury units targeting professionals in the area. It was built by the seller and property developer, Florida East Coast Industries.

One of the main amenities is its direct proximity to MiamiCentral, a major transport hub.

Famous investor Grant Cardone’s firm Cardone Capital purchased the Waterline Miami River Apartment Complex for $100 million.

It was sold by Mast Capital and AEW Capital Management, who jointly built the facility in 2020. The complex is a luxury apartment complex with a large section of water-front multifamily housing.

Notable Sales So Far

In mid-2022, Altis Little Havana was sold by the joint venture that created it, which involved BBX Capital Real Estate.

Based on the joint venture agreement in place, BBX expects to receive $9.4 million from the sale and around $8.4 million from the equity in the joint venture.

There are 224 apartment units completed in 2022 in the complex.

LUMA at Miramar, a 380-unit multifamily facility north of Miami, sold for $133 million. The facility was built in 2019 and has apartments up to three bedrooms.

All apartments are built with luxury features like wood flooring and granite countertops. There is even a Zen garden on-site alongside a yoga studio and fitness center.

It has 100% occupancy.

Market Forecast for the Rest of 2022

In 2022, Miami is expected to see continued growth in rent. Rents are expected to rise at a faster pace than the country as a whole.

This is due to several factors, including the demand for luxury apartments. Miami is seen as a regional hotspot.

Although the area has some of the highest average rents in the country, it is still less expensive than other cities such as San Francisco, Seattle, and New York.

General Investor Activity: Where is the most money flowing?

Money flowed into the Miami multifamily market in 2021.

The reason for this is the potential for capital appreciation and property management companies with strong stable cash flows.

Part of the real estate market’s appeal is that it provides a steady cash flow, even during times of economic hardship.

Rents are generally stable or on the rise, which increases an investment’s value.

Takeaways for Multifamily Investors

Miami is a regional hotspot with high growth potential. The Miami multifamily market report demonstrates the solid fundamentals of this local real estate market.

Property management companies and investors are attracted to Miami’s appeal as a stable destination.

In 2021, investors traded more than $7 billion in multifamily assets in this market.

This was a South Florida record. Investors traded, on average, $1 billion in assets annually between 2009 and 2021.

The long-term prospects for the Miami multifamily market are favorable as increasing numbers of people move to South Florida for better job opportunities and a higher quality of life.

This will likely drive rent growth in the area.

List & Browse Commercial Real Estate in Florida for Free on MyEListing.com!

Sign up for a free account and get unlimited access to our free commercial real estate listings.

You’ll also get access to our comp software, accurate local market intelligence, demographics, and more.

Article Search

Share

All Article Categories