2022 Multifamily Market Report: Atlanta

Specializes in providing actionable insights into the commercial real estate space for investors, brokers, lessors, and lessees. He covers quarterly market data reports, investment strategies, how-to guides, and top-down perspectives on market movements.

Atlanta is among the most popular places in the United States where people are migrating to in 2022.

This has created a situation where the multifamily market is stronger than the national average and will likely make a full economic recovery from the COVID-19 pandemic this year.

Companies with Atlanta-based locations are expanding, creating 77,900 jobs last year. Atlanta will continue to grow and be a strong multifamily market.

In addition, the student housing industry is particularly strong in Atlanta.

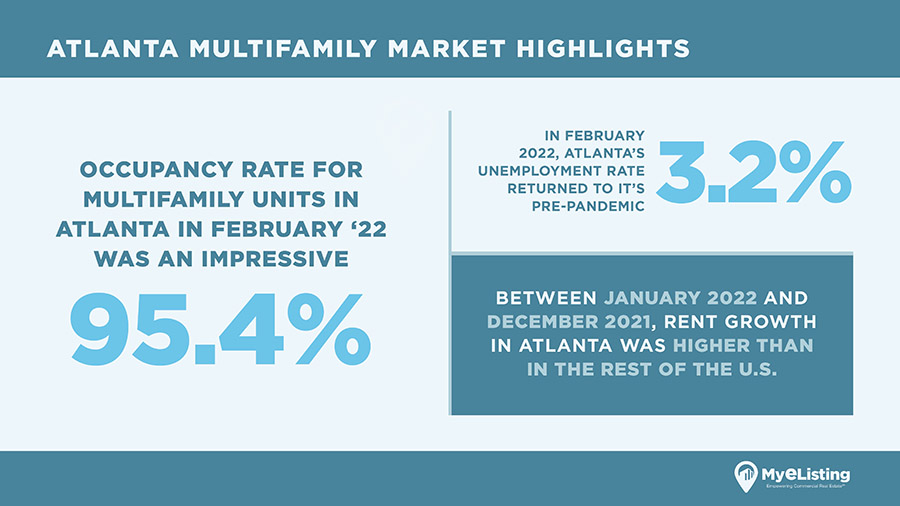

Atlanta Multifamily Market Highlights

The Atlanta multifamily market report details how strong of a market Atlanta is compared to many other larger cities.

Some facts worth noting include:

- Between January 2020 and December 2021, rent growth in Atlanta was higher than in the rest of the U.S.

- Occupancy rate for multifamily units in Atlanta in February 2022 was an impressive 95.4%;

- In February 2022, Atlanta’s unemployment rate returned to its pre-pandemic 3.2%.

Atlanta is a popular city for new renters and families. As remote work and migration toward the Sunbelt positively impact the population, the region will continue to grow.

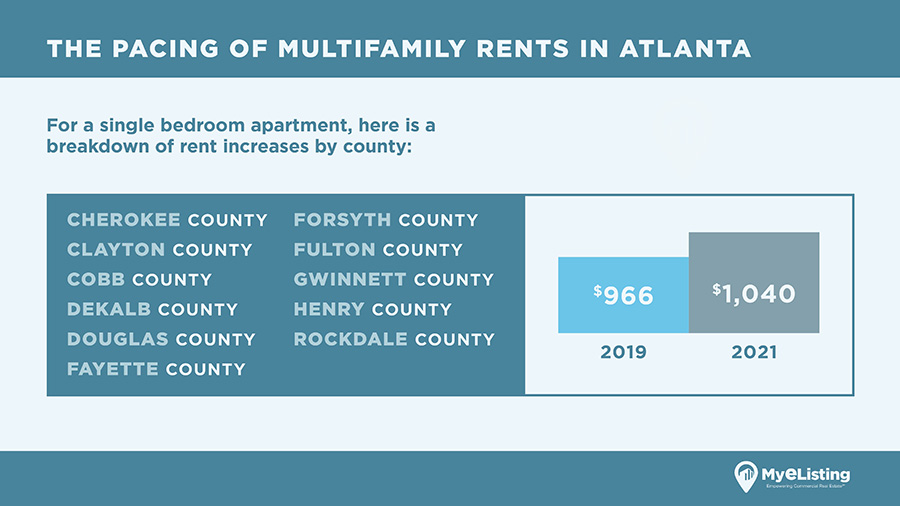

The Pacing of Multifamily Rents in Atlanta

In the U.S., rents rose by 11.3% on average last year. Rents in Atlanta continued to increase.

For a single bedroom apartment, here is a breakdown of rent increases by county:

- Cherokee County from $966 in 2019 to $1,040 in 2021;

- Clayton County from $966 in 2019 to $1,040 in 2021;

- Cobb County from $966 in 2019 to $1,040 in 2021;

- DeKalb County from $966 in 2019 to $1,040 in 2021;

- Douglas County from $966 in 2019 to $1,040 in 2021;

- Fayette County from $966 in 2019 to $1,040 in 2021;

- Forsyth County from $966 in 2019 to $1,040 in 2021;

- Fulton County from $966 in 2019 to $1,040 in 2021;

- Gwinnett County from $966 in 2019 to $1,040 in 2021;

- Henry County from $966 in 2019 to $1,040 in 2021;

- Rockdale County from $966 in 2019 to $1,040 in 2021.

Rent in the Atlanta area in 2022 is much higher than it was in 2021.

However, since the data is not available for the full year of 2022 yet, this is not yet represented in the data that is available.

Long-Term Changes in Rent

As Atlanta goes from being a medium-sized city to a larger one through population growth, the rent prices will increase dramatically.

There are some signs of this already happening in 2022.

Short-Term Changes in Rent

There are many multifamily development projects in the works in Atlanta. While prices are spiking in 2022 for rent, the number of new units continues to rise.

Demand hasn’t yet outpaced supply. Once there is more demand than supply, the rent prices should increase.

Multifamily Sales in Atlanta

In terms of multifamily real estate, there have been many notable sales and acquisitions.

Some of the most notable ones include the following.

Notable Acquisitions So Far

The Radco Consortium bought a 23-story luxury apartment complex for $131 million. It is one of the largest multifamily housing purchases in the city in recent history with 320-units.

It is now the M by Radius and joins Radco’s top luxury brand.

S2 Capital is paying more than $20 million to acquire four properties in Atlanta. In total, the acquisition includes 1,406 vintage units built in the 1980s. S2 has more than $9 billion in transactions.

The four buildings are Woodland Ridge Apartments, Sonoma Ridge Apartment Homes, Pointe at Norcross, and Cornerstone Apartment Homes.

In early 2022, Blackstone announced that it is acquiring seven apartment complexes for $3.7 billion.

This deal is a part of the acquisition of Resource REIT, Inc., which controlled 42 communities across the country.

Early 2022 saw the purchase of an unnamed multifamily housing complex for $36.5 million by Ready Capital.

Ready financed the purchase through a loan from an unnamed source. However, it is known that once the acquisition is complete, the apartments will be renovated and updated.

Notable Sales So Far

Vesta Adams Park, a newly renovated and updated multifamily community, was sold for $42 million.

It was purchased by Brentwood Investment Group, LLC. after being restored from years of neglect and mismanagement.

Berkadia, a real estate investment firm, brokered the sale of Jamco Properties’ 12-property portfolio in Georgia for $375 million.

The sale includes 2,459 apartments, and the deal was financed through Freddie Mac. The buyer was not disclosed.

Atlanta Multifamily Market Forecast for the Rest of 2022

The market forecast for Atlanta is very positive. This is a result of increased population growth and continued migration to the Sunbelt.

In 2022, the Atlanta multifamily market should see consistent rent growth and high occupancy rates. The occupancy rate should continue to remain high in Atlanta over the next two years at above 95%.

General Investor Activity: Where is the most money flowing?

General investors are still making the biggest investments in office properties.

Office properties receive the most money because they are easy to understand and generally have a good ROI.

Despite the fact that there are more single family homes currently in the Atlanta area than multifamily units, there are still more investment dollars flowing into multifamily properties.

This may change in the future.

Takeaways for Multifamily Investors

With a strong multifamily market, the Atlanta area will continue to be a great market for rentals.

Even with high occupancy rates, the rent prices are not high enough to put the multifamily investment industry on a break.

Atlanta has been hit hard during the COVID-19 pandemic.

This year, many companies that lost employees during this pandemic have grown back and expanded their workforce again.

With this growth in companies, there will be more jobs in the Atlanta area in 2022.

List & Browse Commercial Real Estate in Georgia for Free on MyEListing.com!

Sign up for a free account and get unlimited access to our free commercial real estate listings.

You’ll also get access to our comp software, accurate local market intelligence, demographics, and more.

Article Search

Share

All Article Categories