5 Most Expensive Cities to Buy Commercial Real Estate in 2022

Specializes in providing actionable insights into the commercial real estate space for investors, brokers, lessors, and lessees. He covers quarterly market data reports, investment strategies, how-to guides, and top-down perspectives on market movements.

Key Takeaways:

- Miami is the most expensive city to buy commercial real estate, with the average asking price for a commercial property at roughly $12.5 million.

- Los Angeles and San Francisco are both high-tech areas with a promising future as employment rates rise again.

- Despite Las Vegas’s tourism industry taking a hit, there’s new demand for a variety of other businesses to diversify the local economy.

- The COVID-19 pandemic gave New York City’s medical and biotech sector a new boom of opportunities with much potential.

- Even though commercial real estate is expensive in these cities, there is always room for negotiating prices, especially with the help of an experienced broker.

While it isn’t all about the proverbial Benjamins, the truth is that having them does help. But what can you do when you have limited resources, and the mission is to find out where your money will stretch or struggle the most?

It’s time to look at the most expensive cities to buy commercial real estate. Why focus on the most expensive and not only on the most affordable?

Simple: where the price tags are the largest is often where the opportunities lurk.

Distressed properties, syndication deals, off-market deals, and other creative pathways can make the difference between an impossible deal and one that is primed to give that passive income everyone is chasing.

So, here’s a list of the priciest places to buy commercial real estate.

Methodology

All property price averages are based on MyEListing.com commercial listing data as well as publicly available commercial property pricing information.

Any extraneous research mentioned here has been linked.

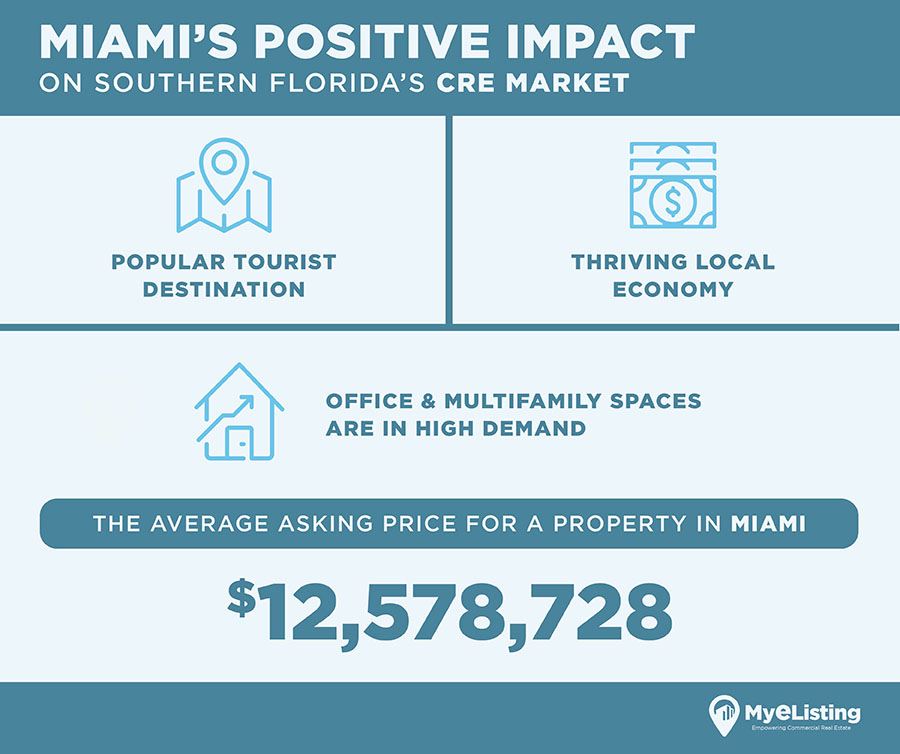

#1 – Miami’s Positive Impact on Southern Florida’s CRE Market

Miami Highlights:

- Popular tourist destination.

- Office and multifamily spaces are in high demand.

- Thriving local economy.

The average asking price for a property in Miami: $12,578,728.80

Are you surprised that Miami is at the top of the list for most expensive cities to pick up commercial property?

It is expected that NYC or even LA would top the list, but Miami has the crown for the time being. Prices in the CRE world can always fluctuate, but every list has to have a winner.

You’re welcome, Miami.

Between a thriving local economy and access to multiple tourism destinations, it isn’t really that shocking that Miami commercial property is at a premium.

The office space rush and an upswing in multifamily properties are already building on the demand that was already present in the area.

Florida’s Local Economy

Due to Florida’s lack of COVID-19 mandated restrictions, businesses in the state have continued to thrive in a time when most businesses in other states have not been able to.

Add in the fact that the state drew in roughly 210,000 new residents between July 2020 and July 2021, there is no income tax for residents, and the state is considered to be overall business-friendly, it makes sense that the local economy is thriving.

The commercial real estate industry in Miami is considered to be one of the leading contributors to the South Florida commercial real estate economy as a whole.

Miami’s Growing Population

In addition to the low income tax and appeal to business owners, there is a draw to Miami due to the variety of cultural influences that the city sees.

The entertainment and party scene has a huge appeal as well.

Currently, Miami is the 42nd most populated city in the country, but the urban area itself claims the spot of 4th largest in the country since it has nearly 5.5 million residents.

Predictions for the Future

Since the commercial real estate market in Miami is so robust, the city is projected to experience even more growth in the coming years.

There is potential for issues with finding space to develop more land, but currently, there is much development for more commercial properties, including office spaces and multi-family spaces.

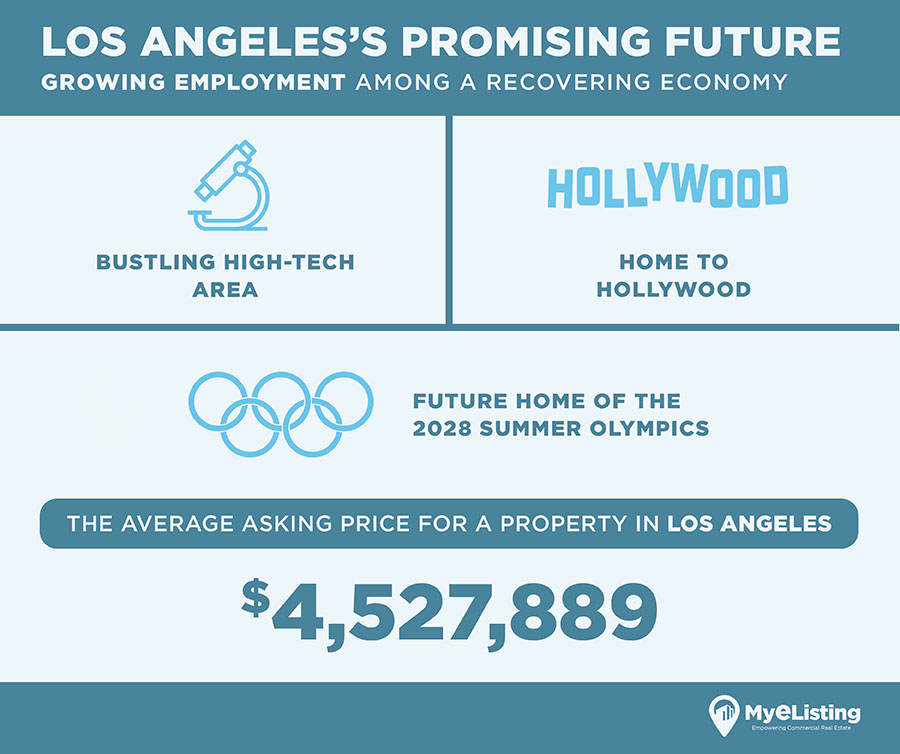

#2 – Los Angeles’s Promising Future: Growing Employment Among a Recovering Economy

Los Angeles Highlights:

- Future home of the 2028 Summer Olympics.

- Bustling high-tech area.

- Home to Hollywood.

The average asking price for a property in Los Angeles: $4,527,889.11

Sunny days abound in LA, and with Hollywood in the background, it’s no surprise that Los Angeles commercial real estate is some of the most expensive in the country.

The greater LA area is a hotbed for high-tech, media, advertising, and even agriculture out in the suburbs.

Los Angeles is tapped for the 2028 Summer Olympics, meaning that it wouldn’t be a bad idea to hunt for commercial property now.

The Summer Olympics has a tendency to really bring in the crowds: 8.2 million people visited London in 2012 for the Summer Olympics. Now that’s a crowd!

Southern California’s Local Economy

Los Angeles County’s employment rates are expected to grow by about 90,000 jobs annually from the years 2020 to 2025.

Many of these jobs are expected to be lower-skilled jobs and only require a high school diploma or less.

LA County should have a promising economic future as it also recovers from the effects of the COVID-19 pandemic.

Los Angeles County’s Appeal to Businesses

Since LA is the hub of various forms of entertainment, technology, and dining, any commercial property in the heart of LA is likely to become a hot spot.

This could be worth it despite the property values.

Businesses can also enjoy tax incentives. For example, new businesses will be exempt from paying their gross receipt tax for three years after opening their business in the city.

A Cultural Melting Pot

One of the greatest appeals of Los Angeles is the way that it melds many different cultures together into one accessible space.

Between Little Tokyo to Little Armenia, there is a variety of different sectors of the city that appeal to different cultures and influences.

#3 – San Francisco’s Appeal to Startup Companies

San Francisco Highlights:

- A high-tech city with a huge economic sector.

- Appealing to tourists.

- Home to the famous Silicon Valley.

The average asking price for a property in San Francisco: $4,256,458.33

San Francisco is like none other, especially for people looking to buy commercial real estate. Like New York City, it’s a melting pot where multiple cultures call home. Let’s also not forget that this is the Bay Area.

It doesn’t get more high-tech than SF, and with Silicon Valley firmly established, it is unlikely that San Francisco CRE prices will go down too far anytime soon.

San Francisco’s power is here to stay between high-tech, venture capital, healthcare, agriculture, pharma, energy, and other economic sectors.

Given the average asking price is quite high, it doesn’t hurt to connect with someone local. That’s a good way to get hidden treasures that aren’t in a database.

Northern California’s Local Economy

Similar to Southern California, Northern California is projected to see an increase in job growth.

California as a whole has seen significant economic recovery, but the North Bay area has recovered economically the fastest compared to the rest of the state.

The biggest concern with commercial real estate is getting workers to transition back to working in the office after all the time of working from the comfort of their own homes.

Despite this, though, commercial real estate in the area also has huge potential in the coming months.

Home of the Startup

San Francisco has become known as one of the epicenters of the startup industry.

The headquarters of major companies such as Twitter, Zynga, and Pinterest, as well being the location for Google and Adobe offices.

San Francisco is a hub for many different parts of the tech industry.

Because of a phenomenon called effect clustering, many other companies will relocate themselves to be near other companies, so that employees of such companies can be near other like-minded individuals.

The Multifamily Comeback

The area’s multifamily market was on the decline during late 2020 and early 2021, but it made its comeback by the fall of 2021.

Since then, the market in this sector has grown; however, there is a concern with the increased development of new multifamily properties.

Overall, multifamily rents in the area are expected to grow by 9.5%, which increases the average monthly rent to over $3,000.

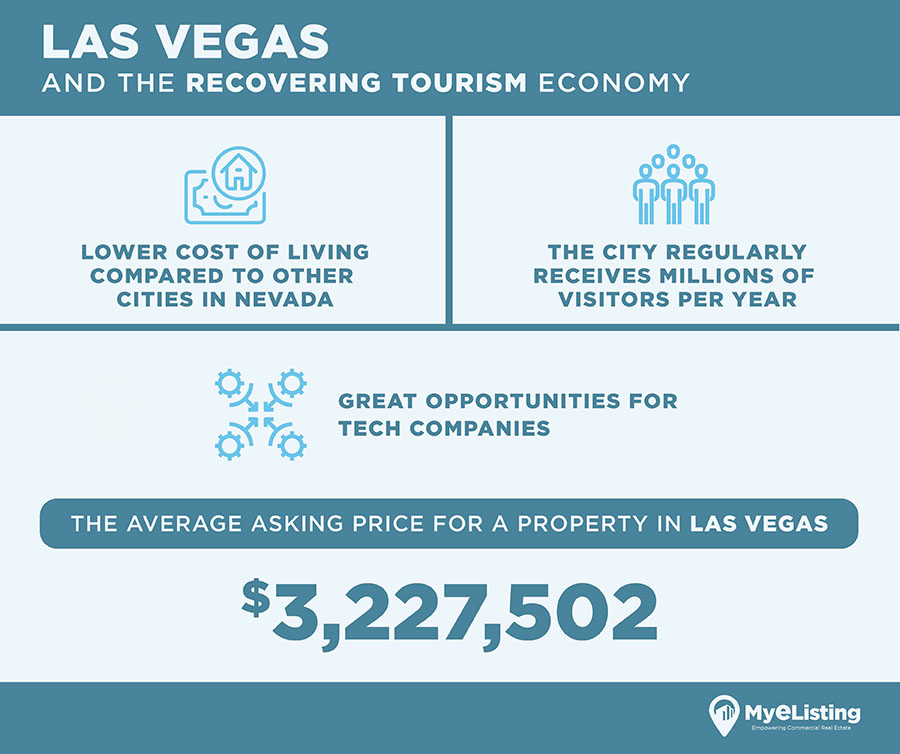

#4 – Las Vegas and the Recovering Tourism Economy

Las Vegas Highlights:

- Lower cost of living compared to other cities in Nevada.

- The city regularly receives millions of visitors per year.

- Great opportunities for tech companies.

The average asking price for a property in Las Vegas: $3,227,502.55

Investing in Las Vegas doesn’t have to be a gamble!

Millions of people visit Las Vegas for more than just the casinos, but the blend of entertainment and hospitality has always allowed the Las Vegas area to be profitable for businesses of all types.

Come for the gambling, stay for a culture that is unique and wonderfully Vegas.

Vegas, like other cities, has had to make some changes in the pandemic and beyond, but the city has experienced a recovery that has only continued to climb.

Visitors and residents alike are looking to return to all of the usual experiences, which has paid off for the area economically.

Nevada’s Local Economy

Even though gaming and tourism have recovered significantly since the blow it took during the early phases of the pandemic, the Vegas area still has the potential to suffer blows due to its heavy reliance on tourism.

With that being said, city leaders are trying to diversify the local economy by putting more focus on industries such as health care, finance, technology, and manufacturing.

Economic Diversification

As previously mentioned, many leaders are trying to encourage other businesses to settle in Southern Nevada and the Las Vegas area.

This is especially true for tech companies; many are predicting that Vegas will turn into the next tech hub.

Diversifying the economy with more types of businesses is great for job growth, which then ends up feeding back into the economy.

Tourism & the Pandemic

Vegas’s tourism industry is slowly recovering, but many experts expect the number of tourists coming in to remain lower than the rate it was prior to the pandemic.

Despite this number being lower than normal, Vegas is still predicted to see 38 million visitors this year.

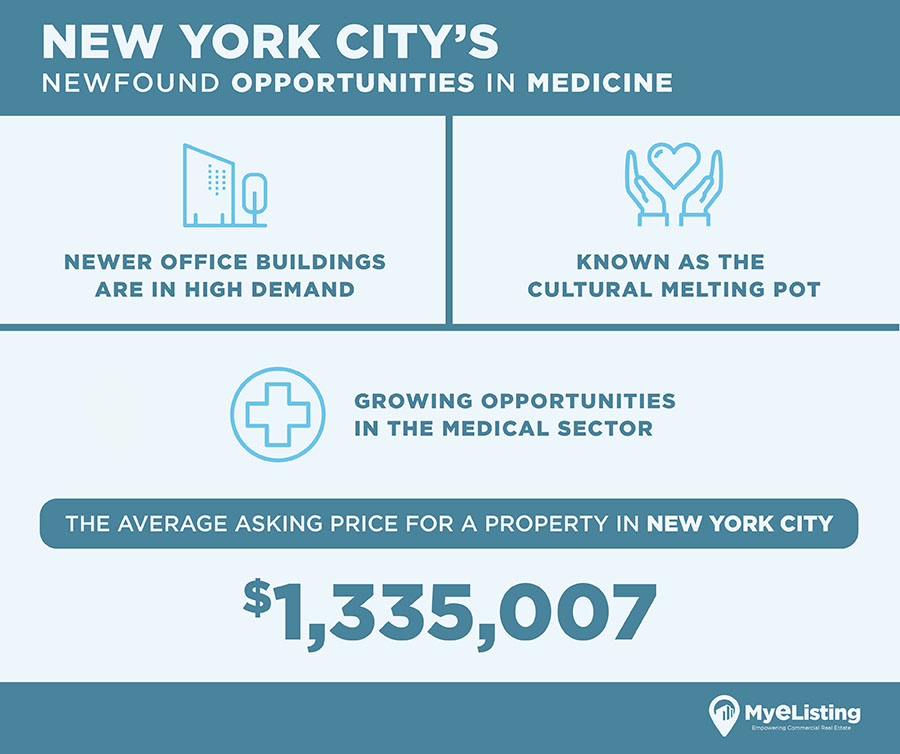

#5 – New York City’s Newfound Opportunities in Medicine

New York City Highlights:

- Known as the cultural melting pot.

- Growing opportunities in the medical sector.

- Newer office buildings are in high demand.

The average asking price for a property in New York City: $1,335,007.13

It’s said that if you can make it in NYC, you can make it anywhere. With residential properties easily creeping past the million-dollar mark, the greater NYC area is well known for having a higher living cost than other areas.

Yet NYC is also a melting pot and a financial powerhouse economically, so it makes sense that people still come seeking opportunity.

There are still plenty of opportunities here; New York City commercial real estate investors simply have to get a little more creative to add more NYC properties to their portfolios.

New York City’s Local Economy

The local economy of NYC is, understandably, a little shaky, but that doesn’t mean that commercial real estate in the city is doomed.

In fact, NYC commercial real estate is doing better than initially predicted.

New York is still facing a relatively high unemployment rate, and new commercial spaces in the area could mean more employment opportunities for those who are seeking it.

Warehousing has seen the greatest increase in employment rates from February 2020 to February of 2022, so it may be a good time to see what you can do with commercial property in that industry.

Rising Medicine and Biotech Demand

The medical and biotechnology sectors of commercial space have unsurprisingly seen lots of growth since the start of the pandemic, and naturally, this means more demand for these spaces.

There is ample opportunity in this sector now; medical startups are dipping their toes in manufacturing home diagnostic tools or creating new apps for telehealth services.

Getting Back to the Office

While many cities are struggling to get their employees back into the office, New York City is having the opposite problem.

Employees are willing to go back to the office due to wanting to reconnect with their colleagues.

Therefore, office space is in very high demand, especially the newer buildings.

The older buildings with less office appeal, on the other hand, have the potential to be converted into homes or other desirable spaces.

Finding Commonalities in the Data

Of course, these are the major cities of the United States. Miami alone has over 8 million people, so it’s not necessarily a shocker that expensive commercial real estate is in the area.

The sheer size of the population means that properties are in high demand, especially with the potential to make income.

The residential and commercial real estate markets certainly do trade off, but they end up working together within an area.

While most are focused on commercial real estate, it’s wise to see the market as a whole and think about the movement of people, even if they’re just trying to find homes in the area.

Those same people are also coming into an area for the amenities, and that’s where the commercial real estate aspect comes in.

Getting Creative to Expand Your Portfolio

As mentioned at the beginning, it’s known that these are areas where expensive real estate abounds. That doesn’t mean that you’ll never be able to invest in the area.

It means that you’re going to have to make sure that you’re coming up with strong plans, timelines, and a deep awareness of the battle ahead.

Don’t let these average CRE prices steer you away; it can’t be stressed enough that so much in the greater real estate world is about negotiation.

You never know what deal you can pull until you start working on it. Using a broker can also help; they know how to negotiate on your behalf.

List & Browse Commercial Real Estate for Sale for Free on MyEListing.com!

You can list and browse commercial real estate for free right here on MyEListing.com.

Simply create a free account and get unlimited access to accurate local market intelligence, customized property type alerts, comp software, demographics, and more.

Article Search

Share

All Article Categories