Vulnerable Cities: A Look at the US Cities at Highest Risk of Commercial Real Estate Loan Defaults

MyEListings' markets and economics editor and creates content about global macro events and their impact on US commercial real estate.

Many businesses rely on commercial real estate loans as a major source of funding, but as economic conditions shift, some borrowers can find it difficult to make their loan payments. The commercial real estate industry has been significantly, though unevenly impacted by the COVID-19 pandemic, and some American cities are therefore more vulnerable to loan defaults than others. Today, we`ll look into which US cities are most susceptible to commercial real estate loan defaults.

Ranking Considerations

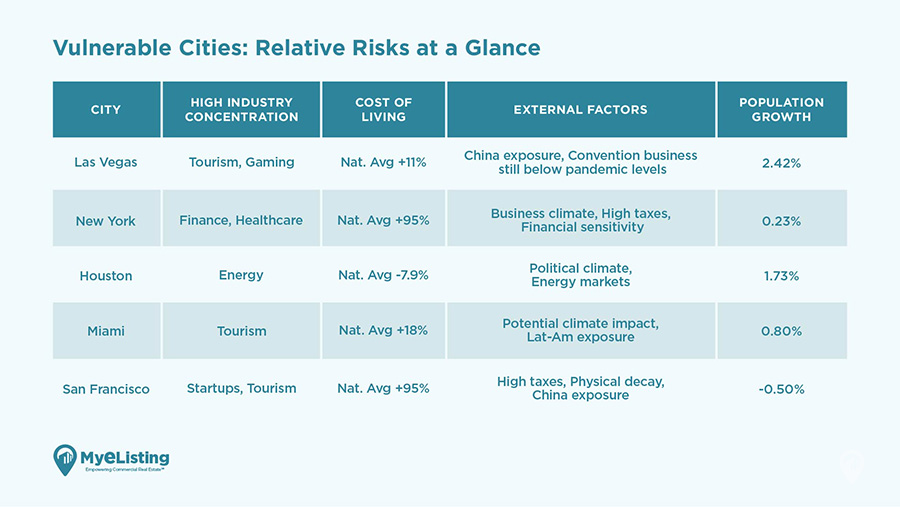

The five cities were chosen because they are particularly susceptible to commercial real estate loan defaults: Las Vegas, New York, Houston, Miami, and San Francisco.

The COVID-19 epidemic has impacted all five cities, resulting in numerous job losses, company closures, and decreased consumer spending. Many borrowers have found it challenging to produce the income required to pay back their debts as a result of the economic unpredictability, especially if they work in sectors like tourism or hospitality that have been particularly badly hit by the pandemic.

Secondly, even in the best of times, it can be difficult for borrowers to keep up with their loan payments due to the relatively high cost of living and conducting business in each of the five cities. This is especially true in places with expensive housing markets and high cost of living, like New York and San Francisco.

Finally, some of the places on the list, like Houston, are more vulnerable than others to external economic variables like changes in the oil and gas sector. The local economy as well as the demand for commercial real estate may be impacted by changes in these businesses.

Each of these cities has distinctive qualities that put them at risk for commercial real estate loan defaults, whether it be Miami`s vulnerability to changes in tourism, New York`s dependence on its financial primacy, or San Francisco`s declining office space demand.

These elements collectively, along with others, raise the possibility of loan defaults on commercial real estate in these five cities relative to others. It is crucial, therefore, to keep in mind that the pandemic`s economic effects have been widespread, if uneven, meaning that borrowers in any location could have trouble repaying their loans.

Las Vegas:

Despite being the world`s hub of entertainment, Las Vegas is particularly susceptible to the COVID-19 epidemic due to its reliance on tourists. Travel restrictions and business closures had a substantial negative impact on the city`s economy, which resulted in a large loss of jobs and a drop in consumer spending. As a result, many companies in Las Vegas are finding it difficult to make their loan payments, which is having an effect on the commercial real estate market. Borrowers could find it challenging to earn the income required to pay off their debts because many casinos and hotels are still operating at reduced capacity.

New York:

The pandemic has only made it harder for borrowers to keep up with their loan payments. New York City has always been one of the most expensive real estate markets in the world. The need for commercial real estate has decreased as a result of the city`s numerous business closures or relocations to remote locations. In addition, many New Yorkers find it challenging to make their mortgage or rent payments due to the city`s high cost of living, which could result in loan defaults for commercial real estate. Lenders have been more cautious due to the uncertainty surrounding the city`s economic recovery, which could limit the number of new loans available.

Houston:

Houston is the fourth-largest city in the US and a key center for the oil and gas sector. Yet, the pandemic has caused a drop in energy demand, which has resulted in job losses and a drop in consumer expenditure. As a result, many Houston firms are battling to survive, which is having an effect on the commercial real estate market. Borrowers could struggle to earn the income necessary to pay off their debts due to the decreased market for commercial real estate, including office space and other sorts. The city`s vulnerability to natural disasters like hurricanes can further increase the risks for borrowers of commercial real estate.

Miami:

The pandemic has had a significant negative impact on the city`s tourism sector, which is famed for its beaches, nightlife, and opulent real estate. It may be challenging for borrowers to produce the income required to pay their debts because many enterprises are shut down or working at a reduced capacity. Borrowers may find it difficult to keep up with loan payments due to Miami`s high cost of living, particularly if they have experienced a job loss or reduced income. Commercial real estate borrowers may also be at greater risk due to the city`s vulnerability to climate change and sea level rise, although insurers still underwrite coastal risks with seeming impunity.

San Francisco:

The epidemic has led to a drop in demand for office space and other types of commercial real estate in San Francisco, which is home to many of the most cutting-edge technology companies in the world. Due to the widespread adoption of remote work in the city, there is less need for pricey office space in the financial district. Borrowers may find it challenging to meet loan obligations due to San Francisco`s notoriously-high cost of living, high tax structure, and other factors influencing people to move, thus subtracting potential commercial rent from the city. Additionally, the risk that commercial real estate borrowers, lenders, and insurers face is increased by the city`s vulnerability to natural disasters such as earthquakes, fires, and mudslides.

To Sum Up

Each of these five locations now faces a higher risk of commercial real estate loan defaults as a result of a variety of variables than in years past. It is, however, crucial to keep in mind that the pandemic has significantly increased economic uncertainty throughout the US, meaning that borrowers in any city could have trouble repaying their loans; these five simply have greater risk to the same set of possibilities. Together, lenders and borrowers should come up with strategies for overcoming these difficulties and lowering the possibility of loan defaults so that acute adverse events can have the opportunity to leave less of a scar on the economy.

While not trivial, defaulting can be done strategically. Several well-regarded REITs and other fund types have, in fact, recently announced their intent to default on debts backed by large office towers in several major cities. This could be unique to present market conditions, as short-term rates have been elevated very quickly, while longer-term rates, which are more influenced by market forces than by mandate, have stayed lower. This scenario changes the calculus for both borrower and lender, as the cost of replacing existing debt is prohibitively costly relative to current (or easily foreseen) rent revenues.

The risks to vulnerable cities are most acute where the potential for financial contagion - high complexity, rate imbalances, shifting populations - are most acute. Short-term, this can be costly for the economy to chew through; longer-term, however, this process likely smooths out the pockets of excess that grew out of the last economic upturn, and encourages green chutes in more locations, when things eventually turn higher.

Article Search

Share

All Article Categories