Thanks to Inflation, Stress Levels Are the Highest in These States & Cities

Specializes in providing actionable insights into the commercial real estate space for investors, brokers, lessors, and lessees. He covers quarterly market data reports, investment strategies, how-to guides, and top-down perspectives on market movements.

Thanks to inflation, nearly half of the country has indicated they’ve been “very stressed” over the last couple of months, and all eyes are still on the current administration’s next move.

To tackle rising costs, the White House recently announced that increasing housing supply is their top economic priority. Since housing costs are about one-third of the consumer price index basket, the goal of the plan is to reduce price pressures by helping those who are having difficulty with high rental rates and other housing costs.

Inflation rose .4% in September, leaving the latest inflation numbers 8.2% higher than it was 12 months ago. It is currently just above the near highest levels since the early 1980’s.

However useful these reports may be, one statistic remains in their shadows: the stress levels of those forced to deal with these rising prices. Seldom does a national stress survey follow the latest inflationary data, and a simple reminder that you’re not alone can go a long way in coping with its effects.

Our team of analysts conducted a report with data taken from the US Census Bureau highlighting the percentages of people feeling “very stressed,” “moderately stressed,” “a little stressed,” and “not stressed out at all” from the latest round of price increases. We wanted to locate the parts of the country feeling the pinch of inflation the most, and what we’ve found is alarming.

Below are some key findings:

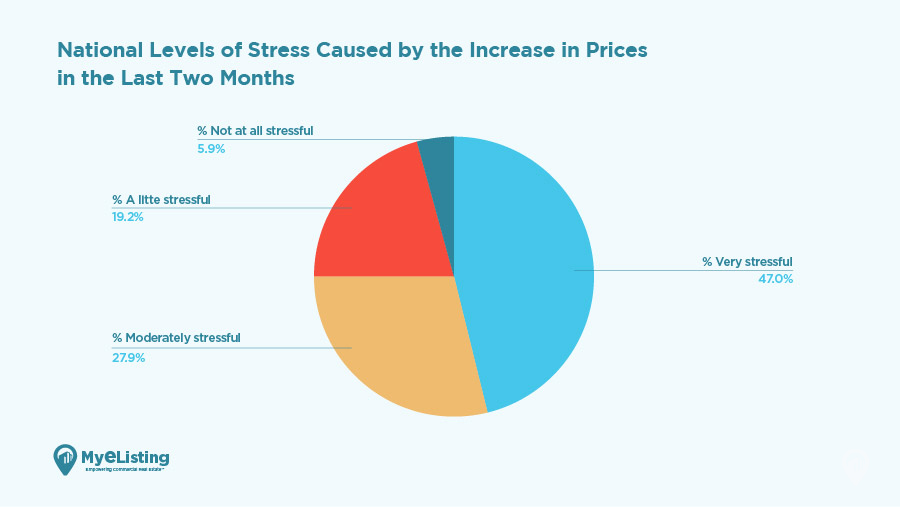

- 47%, nearly half of the country, is “very stressed” out by the increase in prices over the last 2 months.

- Nationally, 28% are “moderately stressed,” 19% a “little stressed”, and 6% are “not stressed out at all.”

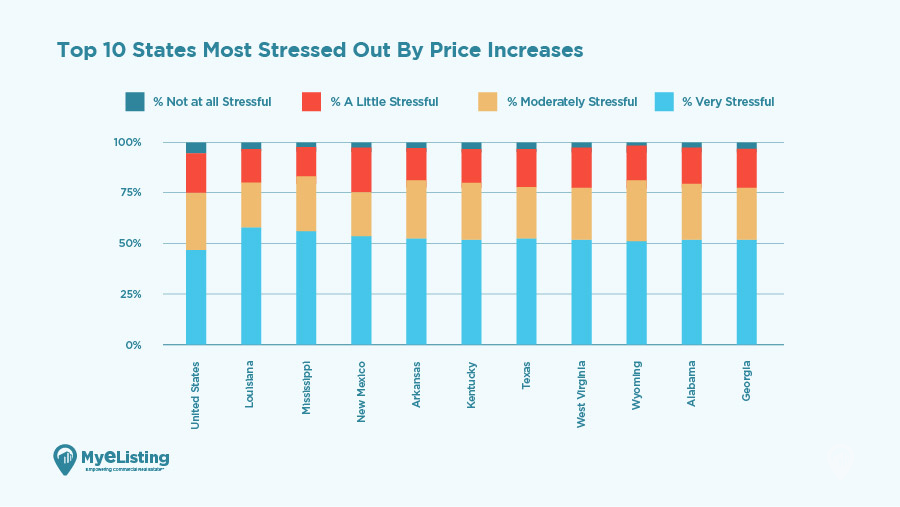

- Louisiana, Mississippi, and New Mexico are most stressed about cost increases.

- Minnesota, Massachusetts, and Colorado are the least stressed out.

- Miami, Houston, and Riverside are the cities most worried about price increases.

Read on for a more in-depth analysis.

National Stress Averages

We found that 47% of the country is very stressed about price increases, 28% are moderately stressed, 19% are a little stressed, and 6% are not stressed out at all.

What’s alarming is that 50% or more of the population in 16 different states have been very stressed about price increases over the last two months. Additionally, in 46 states, more than 40% of people are very stressed about higher prices.

On the other side of the spectrum, less than 8% of people in every state are not stressed out at all by price increases.

States Experiencing the Highest Levels of Stress Due to Inflation

| Rank | State | % Very stressful | % Moderately stressful | % A little stressful | % Not at all stressful |

|---|---|---|---|---|---|

| -- | United States | 47% | 28% | 19% | 6% |

| 1 | Louisiana | 57% | 25% | 14% | 4% | 2 | Mississippi | 57% | 27% | 12% | 4% |

| 3 | New Mexico | 55% | 21% | 19% | 6% |

| 4 | Arkansas | 55% | 27% | 13% | 5% |

| 5 | Kentucky | 53% | 28% | 14% | 5% |

| 6 | Texas | 53% | 25% | 17% | 5% |

| 7 | West Virginia | 53% | 25% | 18% | 4% |

| 8 | Wyoming | 52% | 30% | 15% | 3% |

| 9 | Alabama | 52% | 28% | 15% | 5% |

| 10 | Georgia | 52% | 25% | 18% | 5% |

| 11 | Florida | 52% | 26% | 16% | 6% |

| 12 | Montana | 51% | 29% | 16% | 5% |

| 13 | Delaware | 51% | 24% | 18% | 7% |

| 14 | Tennessee | 50% | 29% | 16% | 5% |

| 15 | Oklahoma | 50% | 29% | 17% | 5% |

| 16 | Nevada | 50% | 26% | 19% | 5% |

| 17 | Missouri | 49% | 28% | 16% | 6% |

| 18 | California | 49% | 27% | 18% | 6% |

| 19 | Arizona | 49% | 27% | 19% | 6% |

| 20 | Kansas | 48% | 27% | 19% | 6% |

| 21 | Indiana | 48% | 30% | 19% | 4% |

| 22 | Ohio | 48% | 28% | 18% | 6% |

| 23 | Hawaii | 47% | 28% | 18% | 6% |

| 24 | Virginia | 46% | 27% | 22% | 5% |

| 25 | New Hampshire | 46% | 25% | 21% | 8% |

| 26 | Idaho | 46% | 31% | 18% | 4% |

| 27 | South Carolina | 45% | 29% | 20% | 6% |

| 28 | Michigan | 45% | 30% | 19% | 6% |

| 29 | South Dakota | 45% | 33% | 18% | 4% |

| 30 | North Carolina | 45% | 28% | 17% | 9% |

| 31 | New York | 45% | 29% | 20% | 7% |

| 32 | Rhode Island | 44% | 25% | 24% | 6% |

| 33 | Pennsylvania | 44% | 31% | 20% | 5% |

| 34 | Utah | 44% | 31% | 20% | 5% |

| 35 | Illinois | 44% | 28% | 21% | 8% |

| 36 | Connecticut | 44% | 26% | 26% | 5% |

| 37 | Nebraska | 43% | 30% | 21% | 5% |

| 38 | Iowa | 42% | 29% | 22% | 7% |

| 39 | Wisconsin | 42% | 31% | 21% | 6% |

| 40 | Oregon | 42% | 26% | 25% | 8% |

| 41 | Vermont | 41% | 26% | 24% | 8% |

| 42 | North Dakota | 41% | 36% | 18% | 5% |

| 43 | Washington | 40% | 30% | 23% | 7% |

| 44 | Maine | 40% | 31% | 22% | 6% |

| 45 | Maryland | 40% | 30% | 24% | 6% |

| 46 | New Jersey | 40% | 33% | 22% | 5% |

| 47 | Alaska | 39% | 35% | 20% | 6% |

| 48 | Colorado | 38% | 30% | 25% | 6% |

| 49 | Massachusetts | 38% | 28% | 26% | 8% |

| 50 | Minnesota | 33% | 31% | 28% | 8% |

We ranked the states, in order from most to least, that were the most stressed out from the most recent price increases:

1. Louisiana

2. Mississippi

3. New Mexico

4. Arkansas

5. Kentucky

6. Texas

7. West Virginia

8. Wyoming

9. Alabama

10. Georgia

Both Louisiana and Mississippi are tied for first on the chart, experiencing the highest percentages stressed out (57%).

Only 4% were not stressed out at all. New Mexico was third on our list, with 55% of the state’s population feeling “very stressed” and only 6% not feeling stressed at all.

Minnesota houses the smallest percentage of “very stressed” Americans at 33%. The state also had the highest rate of those not stressed out at all at 8%.

Individual Metro Figures

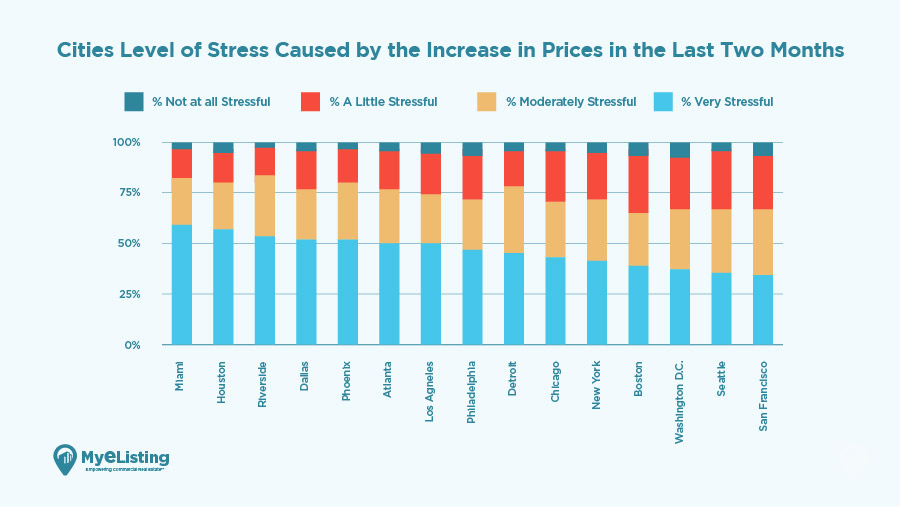

These five metro areas, in order from greatest to least, house the largest percentages feeling “very stressed out” by price increases due to inflation:

1. Miami

2. Houston

3. Riverside

4. Dallas

5. Phoenix

| Rank | City | % Very stressful | % Moderately stressful | % A little stressful | % Not at all stressful |

|---|---|---|---|---|---|

| 1 | Miami | 62% | 23% | 12% | 4% |

| 2 | Houston | 58% | 28% | 13% | 5% |

| 3 | Riverside | 55% | 30% | 14% | 4% |

| 4 | Dallas | 54% | 23% | 19% | 5% |

| 5 | Phoenix | 51% | 27% | 18% | 5% |

| 6 | Atlanta | 51% | 26% | 20% | 5% |

| 7 | Los Angeles | 50% | 25% | 20% | 6% |

| 8 | Philadelphia | 48% | 25% | 23% | 7% |

| 9 | Detroit | 47% | 31% | 17% | 7% |

| 10 | Chicago | 45% | 28% | 21% | 9% |

| 11 | New York | 42% | 32% | 22% | 8% |

| 12 | Boston | 39% | 28% | 28% | 8% |

| 13 | Washington DC | 38% | 29% | 25% | 10% |

| 14 | Seattle | 36% | 31% | 27% | 7% |

| 15 | San Francisco | 35% | 33% | 24% | 10% |

In Miami, 62% of people declared they were very stressed about price increases, the greatest percentage out of the nation’s 15 most populated cities. Only 4% in Miami were not stressed out due to pierce increases.

Miami also had the highest rate in the country for those behind on rent. Since housing accounts for about a third of monthly expenses, the highest stress levels tend to be associated with those who are behind on rent payments.

Houston houses the second-largest percentage of Amercians most stressed about price increases (58%).

Riverside was third most stressed at 55%.

San Francisco had the lowest levels of those very stressed out by price increases at 35%, and 10% who are not stressed out at all.

How Are We Coping With Price Increases?

To cope with these alarming price increases, many have resorted to alternative methods of capital accumulation to keep up with spending needs such as credit cards, bank loans, and even borrowing from friends and family.

We found that 58% of those who have resorted to credit cards or loans to meet spending needs are very stressed out about it. Only 2% are not stressed out about it.

Seventy-nine percent of those who were forced to borrow money from friends or family to meet monthly expenses are very stressed out about it. Even the respondents who used regular income needs, like those received before the pandemic, had a high rate of stress of 40%.

| Used to meet spending needs | % Very stressful | % Moderately stressful | % A little stressful | % Not at all stressful |

|---|---|---|---|---|

| Regular income sources | 40% | 30% | 23% | 7% |

| Credit cards or loans | 58% | 27% | 13% | 2% |

| Money from savings or selling assets or possessions | 61% | 27% | 11% | 2% |

| Borrowing from friends or family | 79% | 15% | 5% | 1% |

| Money saved from deferred or forgiven payments | 66% | 23% | 9% | 1% |

Additionally, many feel stress due to the lifestyle changes they’re being forced to make. Whether it be shopping at less expensive stores, eating out less, or canceling subscription services, the country is feeling stress across the board.

For example, 69% who purchase less fresh produce and/or meat are very stressed out due to price increases. Additionally, 76% of those who delayed medical treatment are feeling very stressed about it. For all categories, for those who changed their spending habits and lifestyle, less than 2% are not feeling any stress at all.

| Changes in Lifestyle | % Very stressful | % Moderately stressful | % A little stressful | % Not at all stressful |

|---|---|---|---|---|

| Shop at stores that offer lower prices | 54% | 29% | 15% | 2% |

| Switch from name brand to generic | 59% | 28% | 12% | 2% |

| Purchase less fresh produce and/or meat | 69% | 23% | 7% | 1% |

| Eat out/food delivery less often | 53% | 30% | 15% | 2% |

| Cancel or reduce subscription services | 63% | 25% | 11% | 1% |

| Cancel or decrease event plans | 65% | 25% | 9% | 1% |

| Drive less/change transportation | 62% | 26% | 11% | 1% |

| Delay major purchases | 60% | 28% | 11% | 1% |

| Delay medical treatment | 76% | 19% | 4% | 0% |

| Work additional job(s)/shift(s) | 67% | 24% | 8% | 1% |

| Contribute less to savings/retirement | 62% | 27% | 10% | 1% |

| Increase use of credit cards, loans | 68% | 24% | 8% | 1% |

| Decrease use of utilities | 67% | 22% | 9% | 1% |

| Move to less expensive housing | 72% | 20% | 7% | 1% |

| Ask friends and/or family for help | 79% | 16% | 5% | 0% |

| Change or reduce plans for childcare | 79% | 15% | 6% | 0% |

| Did not made any changes | 11% | 14% | 38% | 37% |

Is the Nation on Its Way to a Mental Health Crisis?

If price increases don’t stabilize soon, this data shows that the nation may be headed for yet another crisis, one more invisible and more difficult to defeat.

To combat these debilitating rises in prices, the White House recently announced a five-year plan to tackle inflation. The plan is to increase the supply of affordable housing and offer rental assistance programs that have since dried up after the pandemic.

The goal is to ease the burden of housing costs over time by focusing on building rental housing for low and middle-income families. The question on everyone’s mind: Will this be enough?

Methodology

MyEListing.com analyzed the US Census Household Pulse Survey on the level of stress caused by the increase of prices in the last two months in September of 2022. The percentage of stress levels is distributed by the number of people who felt very stressed, moderately stressed, a little stressed, and not stressed at all relative to the number of survey respondents. Finally, we ranked each state and the top 15 most populated metro areas based on available data.

Article Search

Share

All Article Categories