2022 Office Space Report: Fort Lauderdale

Specializes in providing actionable insights into the commercial real estate space for investors, brokers, lessors, and lessees. He covers quarterly market data reports, investment strategies, how-to guides, and top-down perspectives on market movements.

The office market in Fort Lauderdale, Florida is not as strong as those in Miami-Dade and Palm Beach counties.

Many companies in Broward County shrunk their office footprint or closed offices during the COVID-19 pandemic.

While you’ll notice that the office market is starting to recover in this Fort Lauderdale office space report, it will take time for this sector to return to pre-pandemic levels.

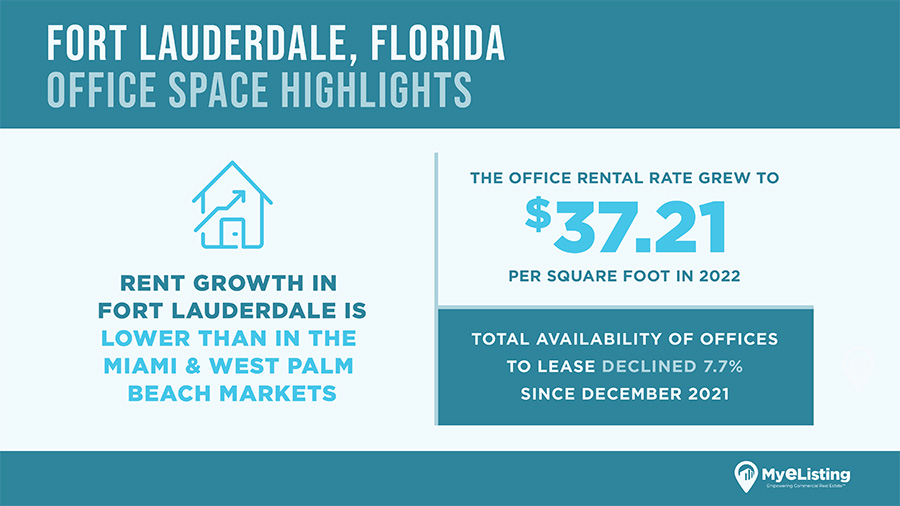

Fort Lauderdale Office Space Highlights

Some highlights from this Fort Lauderdale office space report include:

- Rent growth in Fort Lauderdale is lower than in the Miami and West Palm Beach markets.

- The office rental rate in Fort Lauderdale grew to $37.21 per square foot in 2022.

- Total availability of offices to lease declined 7.7% since December 2021.

While Fort Lauderdale is not experiencing the migration demand that Miami and West Palm Beach are, it benefits from its proximity to these more active markets.

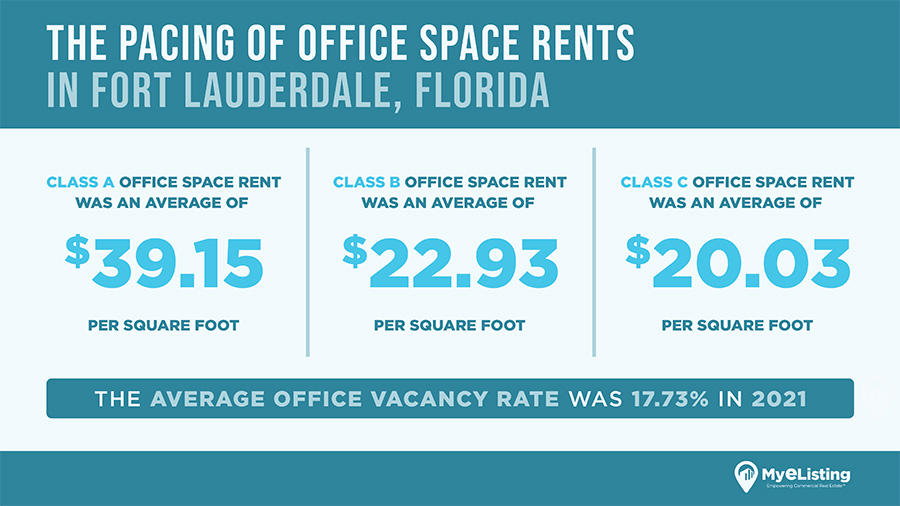

The Pacing of Office Space Rents in Fort Lauderdale

The national vacancy rate for office rentals is 15.4%, whereas the average listing cost is $33.08 a square foot. In Broward County:

- The average office vacancy rate was 17.73% in 2020.

- Class A Office Space rent was an average of $39.15 per square foot.

- Class B Office Space rent was an average of $22.93 per square foot.

- Class C Office Space rent was an average of $20.03 per square foot.

Despite lower rent growth rates in Fort Lauderdale when compared to the surrounding areas, the Fort Lauderdale office space report demonstrates that the cost of renting office space in the area is higher than the national average.

Long-Term Changes in Rent

Fort Lauderdale is expected to see significant improvement over the long term. Consistent growth is being spurred by companies relocating to the area.

With the number of companies in the area increasing, demand is expected to rise as companies begin the big push back to the office.

Short-Term Changes in Rent

Fort Lauderdale is experiencing an increase in office space demand due to people relocating to Florida.

A combination of warmer weather and reduced regulations regarding COVID-19 are driving growth in the market, including pushing up demand from businesses that need office space to grow.

Office Space Sales in Fort Lauderdale

The office space market in Fort Lauderdale is seeing some significant changes as investors take advantage of current market conditions.

Here are several notable acquisitions and sales in the Fort Lauderdale office space market.

Notable Acquisitions So Far

Anchor Health Properties spent $45.5 million to acquire a medical office building in nearby Plantation.

The large office is 95,777 square feet. Starwood Capital Group made the sale to a joint venture that includes Harris Street.

This is the latest purchase in a series of medical office transactions in Fort Lauderdale over the last few months.

Notable Sales So Far

CP Group purchased Las Olas Square for $144.5 million in March 2022. This property consists of two buildings, including a 17-story office tower and a 3-story mixed-use building.

In February 2022, a New York-based developer purchased the large office building at 707 S.E. Third Avenue for $33 million. The building is as big as a city block.

Market Forecast for the Rest of 2022

With a decrease in the office vacancy rate, Fort Lauderdale will start to see an increase in lease rates.

The supply of space will also start to grow with the introduction of new projects while demand remains constant.

The office market in Fort Lauderdale is seeing higher levels of supply as more projects come online over the next four years.

The total amount of available space is expected to increase through a combination of both new construction and conversion projects.

General Investor Activity: Where is the most money flowing?

The majority of investors are still looking to buy residential properties in the West Palm Beach and Miami areas.

The commercial market is fueled by a high demand for retail space. Retail is one of the strongest sectors in the area.

There is a large demand due to the fact that the retail environment in this south Florida region is very competitive.

As a result, investors are moving away from the office market. The office environment in this area is not as strong as it was before COVID-19.

Since the COVID-19 pandemic, vacancy rates have increased and rent growth has slowed significantly in this sector compared to other types of real estate investments.

Takeaways for Office Space Investors

There are many opportunities in South Florida due to the large number of companies that are located in the area.

Office investment provides investors with a great way to diversify their portfolios.

The commercial real estate market in Fort Lauderdale is experiencing mixed levels of demand and supply for office space, creating a tough environment for investors who want to enter the market. Companies want Class A properties the most.

Mixed-use space demand is high, which has driven many Fort Lauderdale office investors to purchase these properties, especially in the tourist district of downtown Fort Lauderdale.

Mixed-use spaces offer flexibility to tenants. They can be used for various purposes, including retail, office, or residential.

Investors should expect a slow recovery of office space in the area. The consistent growth of companies in the area has helped to push down vacancy rates, which will help to fuel future growth in the sector.

Investors should look at the short-term factors at a local level in Fort Lauderdale to see what is driving the market.

An office space report on an area will provide important insights into which sector of the market has more demand, supply, and inventory, and therefore have higher levels of investment growth potential.

List & Browse Fort Lauderdale Office Space for Free on MyEListing.com!

You can list and browse Fort Lauderdale office space for free right here on MyEListing.com by signing up for a free account.

You’ll also get unlimited access to accurate local market intelligence, customized property type alerts, comp software, and more.

Article Search

Share

All Article Categories