2022 Multifamily Market Report: Nashville

Specializes in providing actionable insights into the commercial real estate space for investors, brokers, lessors, and lessees. He covers quarterly market data reports, investment strategies, how-to guides, and top-down perspectives on market movements.

2021 was a strong year for the Nashville multifamily market. This market saw a 16.6% YOY increase in rent growth.

While rent expansion is only performing at the national rate, the Nashville market remains a strong choice for multifamily investors looking to capitalize on the trend toward migration into the Sunbelt.

The occupancy rate was an impressive 96.3% in October 2021.

While the hospitality and entertainment sectors saw improvement in job gains and growth, other service-based businesses including IT and e-commerce also drove some commercial expansions in the area.

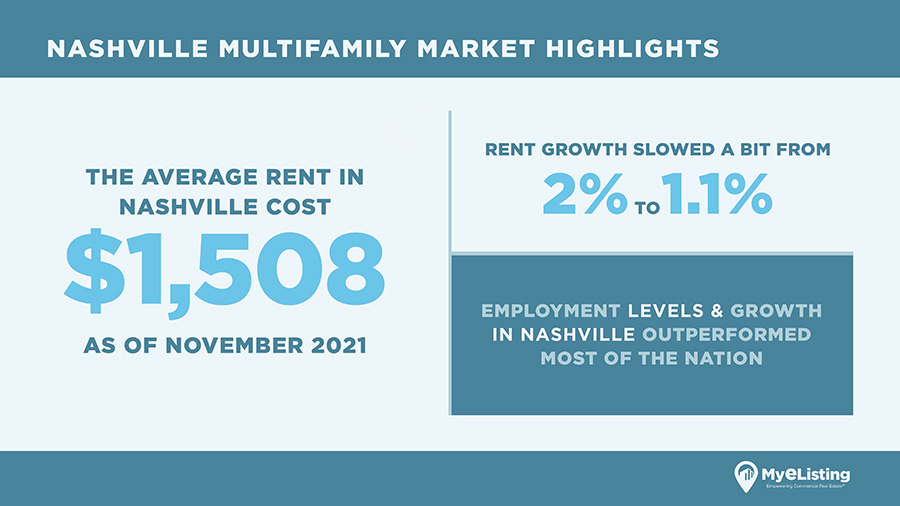

Nashville Multifamily Highlights

This Nashville multifamily market report demonstrates that Music City, USA has a very strong multifamily market.

Some highlights worth noting include:

- The average rent in Nashville cost $1,508 as of November 2021;

- Rent growth slowed a bit from 2% growth to 1.1% growth;

- Employment levels and growth in Nashville outperformed most of the nation.

While rent growth may have slowed down over the short term, other signals point to long-term growth in the future, including large-scale investments and strong employment gains.

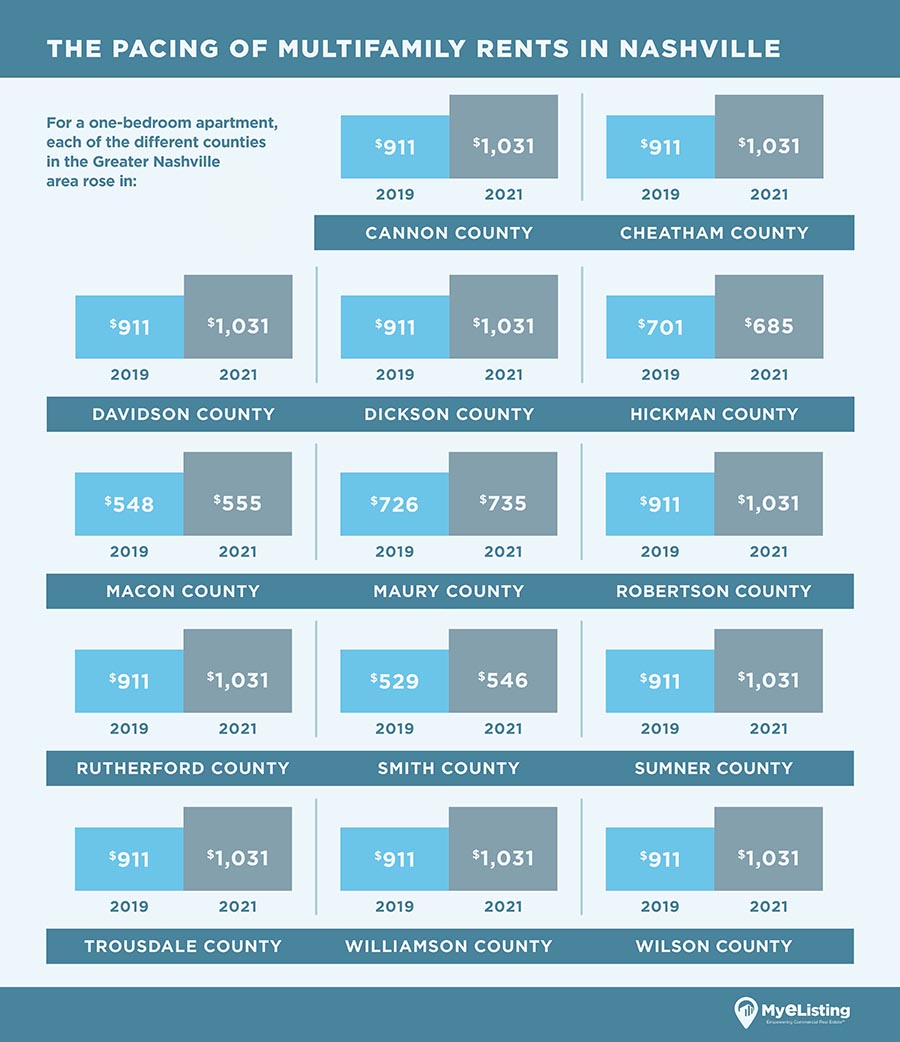

The Pacing of Multifamily Rents in Nashville

American rents rose by 11.3% on average in 2021. In the Nashville Metropolitan Statistical Area, rents rose more modestly.

For a one-bedroom apartment, each of the different counties in the Greater Nashville area rose in:

- Cannon County from $911 in 2019 to $1,031 in 2021;

- Cheatham County from $911 in 2019 to $1,031 in 2021;

- Davidson County from $911 in 2019 to $1,031 in 2021;

- Dickson County from $911 in 2019 to $1,031 in 2021;

- Hickman County from $701 in 2019 to $685 in 2021;

- Macon County from $548 in 2019 to $555 in 2021;

- Maury County from $726 in 2019 to $735 in 2021;

- Robertson County from $911 in 2019 to $1,031 in 2021;

- Rutherford County from $911 in 2019 to $1,031 in 2021;

- Smith County from $529 in 2019 to $546 in 2021;

- Sumner County from $911 in 2019 to $1,031 in 2021;

- Trousdale County from $911 in 2019 to $1,031 in 2021;

- Williamson County from $911 in 2019 to $1,031 in 2021;

- Wilson County from $911 in 2019 to $1,031 in 2021.

Despite some increases in the urban areas around Nashville, there are still many affordable places to rent in the Greater Nashville area.

This affordability combined with the warm weather will continue to attract new renters into the market.

Long-Term Changes in Rent

Over the long term, the investments and renovations within the Nashville multifamily market will increase the overall cost of rent in Nashville.

While it is still affordable, it is a good time to invest in multifamily properties to ensure a successful return on investment.

Short-Term Changes in Rent

Rent prices are rising over the short term in Nashville.

While the cost of rent isn’t rising as quickly as in some other markets such as Tampa, Atlanta, and Phoenix, there are still some short-term improvements.

Multifamily Sales in Nashville

In this past year, there have been many notable multifamily sales and acquisitions within the Nashville market.

Some notable ones include the following.

Notable Acquisitions So Far

Lion Real Estate Group completed a two-facility sale for $77.25 million. The Ellington and Brentwood Station contain 585 units.

Both are located in an area that is seeing rapid population growth and development, making them great investments for the buyer.

In late 2021, Lument secured a bridge loan worth $13.8 million to acquire Covenant Crossing.

The sale was brokered by Old Capital and the loan will cover the costs of renovating the community.

Station 40 was purchased by Velocis Partners for $71.8 million. The community was constructed in 2016 and consists of two multi-story buildings.

Its previous sale was in 2018 and it sold for $51.8 million, showing a marked increase in value in the most recent sale.

Notable Sales So Far

Property Markets Group (PMG) purchased land in Nashville for $22 million from Market Street to build a new mixed-use multifamily project with 471 units.

Called Society Nashville, the property will be a part of the company’s “Social Living” brand to offer apartments with more affordable rents near urban areas.

CBRE helped to arrange the sale of The Eastland apartment community in Nashville for $14.9 million from the Lion Real Estate Group to the Cherner Development Group, based in Virginia.

The five-story apartment complex has 49 units. Construction on the facility was finished in 2017 and it had 96% occupancy when sold.

Nashville Multifamily Market Forecast for the Rest of 2022

Green Street Analytics predicts a record-breaking 13.5% increase in net operating income for multifamily unit owners.

While the income from multifamily housing is at record-highs, Nashville has also seen strong population growth.

This continued strong in-migration will improve the outlook for multifamily as it creates a need for more units.

Overall, this is an excellent time to invest in multifamily buildings.

Nashville’s hot economy and increasing population growth will guarantee that this city remains one of the nation’s strongest markets over the next few years.

General Investor Activity: Where is the most money flowing?

In Nashville, investors are investing in hospitality, leisure, and professional businesses.

The top service-related industries include education, transportation, health care, and business support.

This is in line with the overall trend toward migration into the Sunbelt.

Takeaways for Multifamily Investors

This Nashville multifamily market report shows that the area has a strong multifamily market and that there is an opportunity for investors looking to capitalize on the migration into the Sunbelt.

The market benefits from its warm weather and affordable rents, which will continue to attract new renters in the future.

While long-term rent prices will rise, short-term prices are still rising as some good capital investments by owners of multifamily buildings pull up values.

List & Browse Commercial Real Estate in Tennessee for Free on MyEListing.com!

Sign up for a free account and get unlimited access to our free commercial real estate listings.

You’ll also get access to our comp software, accurate local market intelligence, demographics, and more.

Article Search

Share

All Article Categories